Question:

Do problem 4 again assuming you believe the September 2013 spot price will be $0.07061 per MXN.

Data From Problem 4

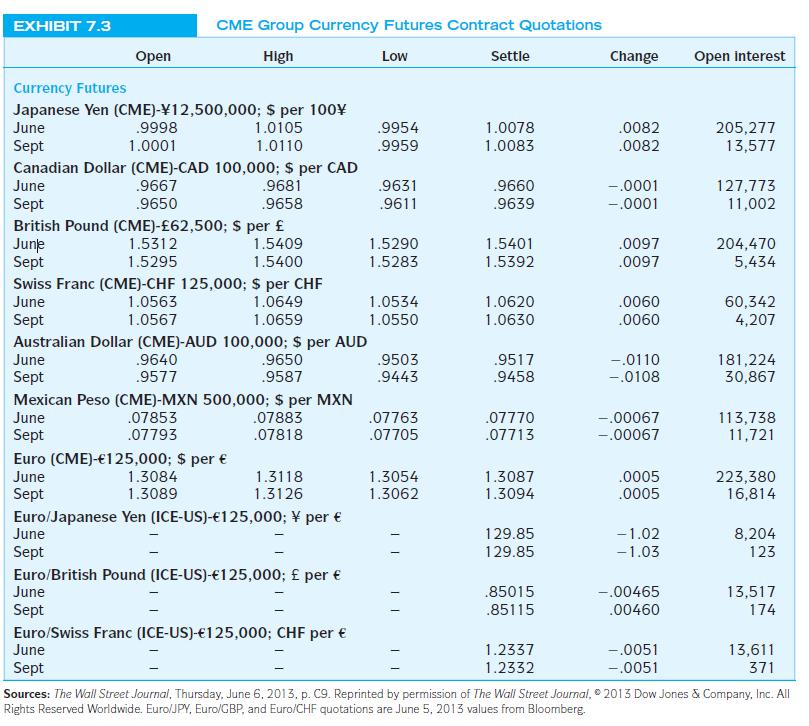

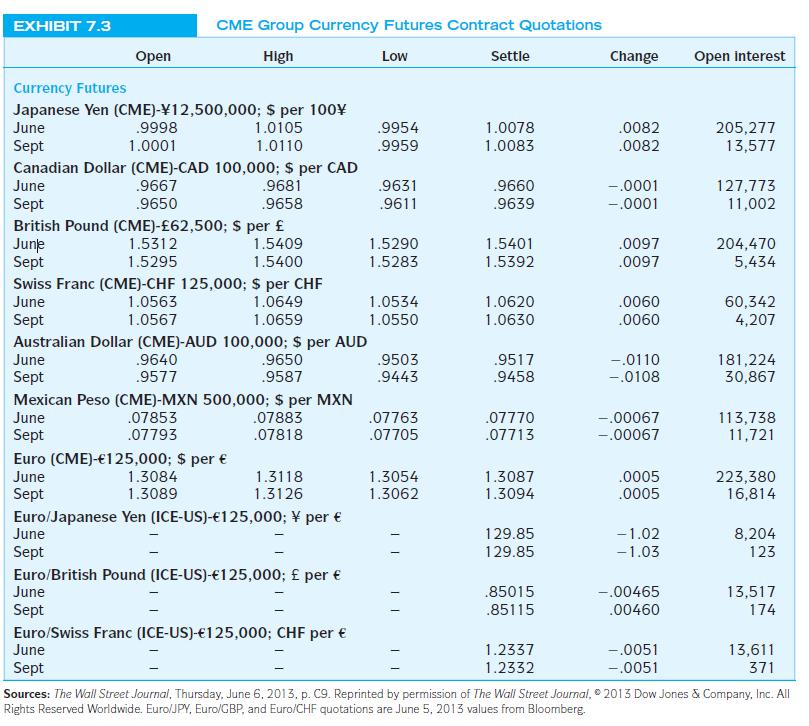

Using the quotations in Exhibit 7.3 , note that the September 2013 Mexican peso futures contract has a price of $0.07713 per MXN. You believe the spot price in September will be $0.08365 per MXN. What speculative position would you enter into to attempt to profit from your beliefs? Calculate your anticipated profits, assuming you take a position in three contracts. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes?

Transcribed Image Text:

EXHIBIT 7.3 June Sept Currency Futures Japanese Yen (CME)-12,500,000; $ per 100% 1.0105 1.0110 Canadian Dollar (CME)-CAD 100,000; $ per CAD June .9667 .9681 Sept .9650 .9658 Open June Sept .9998 1.0001 British Pound (CME)-62,500; $ per 1.5409 1.5400 CME Group Currency Futures Contract Quotations High Low 1.5312 1.5295 June Sept Swiss Franc (CME)-CHF 125,000; $ per CHF June 1.0649 Sept 1.0659 1.0563 1.0567 Australian Dollar (CME)-AUD 100,000; $ per AUD June .9640 .9650 Sept .9577 .9587 Mexican Peso (CME)-MXN 500,000; $ per MXN .07853 .07883 .07793 .07818 Euro (CME) -125,000; $ per June Sept 1.3084 1.3118 1.3089 1.3126 Euro/Japanese Yen (ICE-US)-125,000; per June Sept Euro/British Pound (ICE-US)-125,000; per June Sept Euro/Swiss Franc (ICE-US)-125,000; CHF per June Sept .9954 .9959 .9631 .9611 1.5290 1.5283 1.0534 1.0550 .9503 .9443 .07763 .07705 1.3054 1.3062 Settle 1.0078 1.0083 .9660 .9639 1.5401 1.5392 1.0620 1.0630 .9517 .9458 .07770 .07713 1.3087 1.3094 129.85 129.85 .85015 .85115 1.2337 1.2332 Sources: The Wall Street Journal, Thursday, June 6, 2013, p. C9. Reprinted by permission of The Wall Street Journal, Rights Reserved Worldwide. Euro/JPY, Euro/GBP, and Euro/CHF quotations are June 5, 2013 values from Bloomberg. Change .0082 .0082 - .0001 -.0001 .0097 .0097 .0060 .0060 -.0110 -.0108 -.00067 -.00067 .0005 .0005 - 1.02 -1.03 -.00465 .00460 Open interest -.0051 -.0051 205,277 13,577 127,773 11,002 204,470 5,434 60,342 4,207 181,224 30,867 113,738 11,721 223,380 16,814 8,204 123 13,517 174 13,611 371 2013 Dow Jones & Company, Inc. All