INTERNATIONAL MACHINERY PLC is interested in establishing a small manufacturing operation in China. The expected NPV for

Question:

INTERNATIONAL MACHINERY PLC is interested in establishing a small manufacturing operation in China. The expected NPV for this operation is– €6 million. The justification for this loss-making operation is that it could lead to a more profitable investment opportunity when the company has more experience of doing business in China. The issue is whether the company should move forward with this €10 million preliminary investment.

After five years, the company might shut down the operation, depending on economic and political developments in China. Alternatively, the company might commit €100 million to further investment at that time.

If the NPV should turn out to be negative, the company expects to shut down its operations in China. The expected value for the PV of the contributions in five years’

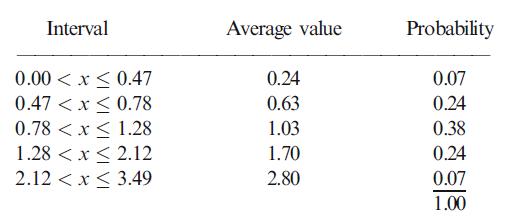

time equals €116 million. But the expected spread around this value is quite large, however, as indicated in the following table for the PI prepared by the company’s analysts.

The discount rate used for the PV of these investments is 25%.

(a) What is the PV of the real option to make the further investment in China?

(b) Should the company make the initial negative NPV investment in China?

Step by Step Answer: