Referring to the problems above, use Method 2 to find the before-tax NPV in euros for GLOBALS

Question:

Referring to the problems above, use Method 2 to find the before-tax NPV in euros for GLOBAL’S project in Anderia.

Data From Above Problems:-

1. Economic forecasters predict a 17% annual rate of inflation for Anderia and a rate of only 3% for the euro zone during the next five years. The current spot rate of exchange is Al.2222/€1.00. Use PPP to give an unbiased forecast of the exchange rate for each of the next five years.

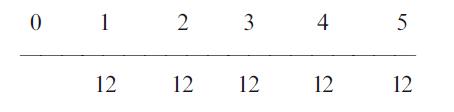

2. GLOBAL will sell the Ventgo product in the EU. The following is the expected real before tax net cash flow (€ million) resulting from selling the product.

Problem 1 gives the corresponding manufacturing cash flows in Anderian dollars (millions)

before tax. The current spot rate of exchange is A1.2222/€l .00. Using Method 1, find the NPV of the project’s before-tax cash flows.

Data From Problem 1:-

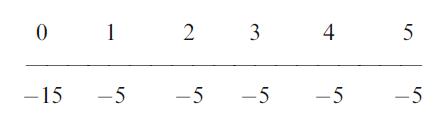

GLOBAL ENTERPRISE plc is an international manufacturing company domiciled within the EU. The company plans the Ventgo project for manufacturing in Anderia, a sovereign nation outside the euro zone. So, the manufacturing costs will be denominated in Anderian dollars (A). Labor costs in Anderia are low, but the country exacts a relatively high 50% rate of Corporation Tax. The country does not tax dividends remitted by inward investors to foreign countries, however. Given below are the expected (real) manufacturing cash flows in Anderian dollars (millions) for the five-year project.

Economic forecasters predict a 17% annual rate of inflation for Anderia. Calculate the expected nominal annual before-tax manufacturing cash flow in Anderian dollars for the Ventgo project.

Step by Step Answer: