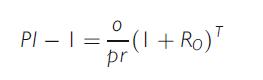

The analyst used the following equation to obtain the value PI1= 1:77 supplied in Problem 6: For

Question:

The analyst used the following equation to obtain the value PI–1= 1:77 supplied in Problem 6:

For example, suppose the PV o of each real investment option equals 0.314 per unit of investment and the probability pr of investing is 0.50. The value of RO given in Problem 6 is 23%. The expected time T for each real investment option to mature is five years.

Calculate the future net value PI–1 of an investment opportunity having these characteristics.

Data From Problem 6:-

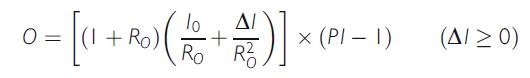

After obtaining the PV of the cash flows from IPCO’s existing products, the next step is to calculate the PV of the company’s investment of opportunities. The analyst favors using the value 1.77 for the PI of the new investments. She suggests discounting the net future values It × (PV – 1) using a discount rate RO equal to 23%. The initial annual investment expenditure I0 is 40. This annual investment is expected to grow by ΔI = 4 per year. Use this information in the following equation given in the chapter to obtain the PV of the investment opportunities:

Step by Step Answer: