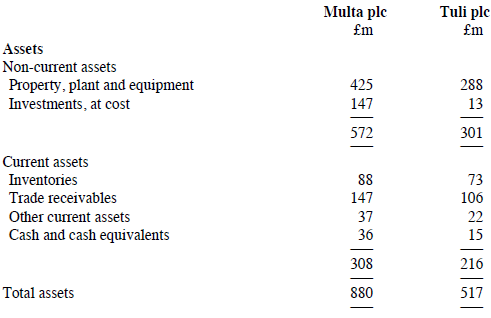

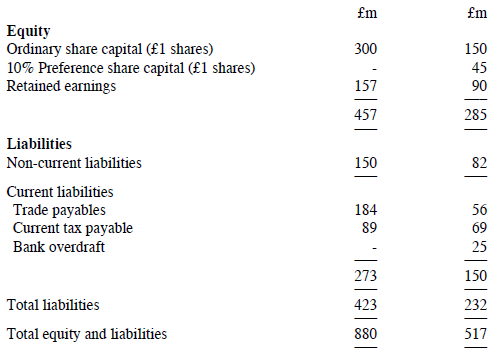

The following are the statements of financial position of two companies at 31 October 2018, the end

Question:

The following additional information is available:

1). On 1 November 2016 Multa plc purchased 90,000,000 ordinary shares in Tuli plc paying a total of £120,000,000. The reserves of Tuli plc on 1 November 2016 were £30,000,000. It was agreed that all the assets and liabilities of Tuli plc were reported in its financial statements at fair values as at 1 November 2016. Since then the directors of Multa plc feel that the amount paid for as goodwill upon the acquisition has been impaired by £3,000,000.

2). During the year ended 31 October 2018 Multa plc sold inventory to Tuli plc for £25,000,000. Multa plc earned a uniform margin of 40% on these sales. During the year ended 31 October 2018 Tuli plc resold 80% of this inventory. On 31 October 2018 Tuli plc had unpaid invoices totalling £18,000,000 payable to Multa plc in respect of these purchases.

3). Each ordinary share in Tuli plc carries one vote and there are no other voting rights in the company.

Required:

(a) Calculate the amount paid as goodwill on the acquisition of Tuli plc on 1 November 2016.

(b) Prepare with full supportive workings the consolidated statement of financial position of Multa plc as at 31 October 2018.

(CIPFA)

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

International Financial Reporting A Practical Guide

ISBN: 978-1292200743

6th edition

Authors: Alan Melville