The table below provides the expected after-tax net incremental cash flow for one of the machines to

Question:

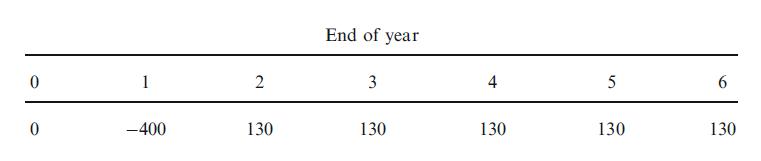

The table below provides the expected after-tax net incremental cash flow for one of the machines to be installed in Spacemonitor’s new factory:

The company’s financial analyst was unhappy with the company’s conventional procedure of treating all cash flows as though they occur at the end of each year. Completing the factory would take approximately one year, and investment in machinery will not take place until completion. So, operations cannot start until the beginning of the second year.

He was also aware that cash income spreads quite evenly over each year of operation and certainly not concentrated at the end of each year. He felt it would be a better approximation to treat the cash income as though it occurred at the middle of each year.

(a) What is the NPV of the machine based on end-of-year discounting?

(b) What is the NPV of the machine based on mid-year discounting?

(c) What is the financial reason for the difference between your results in (a) and (b)?

Step by Step Answer: