Wilbern Ltd prepares financial statements to 30 June each year. On 1 March 2023, the company classifies

Question:

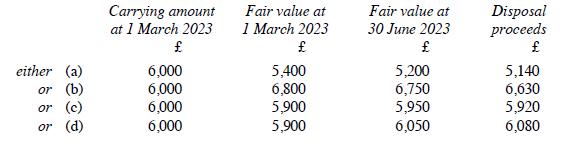

Wilbern Ltd prepares financial statements to 30 June each year. On 1 March 2023, the company classifies a non-current asset as held for sale. The asset is eventually sold in July 2023. Calculate:(i) Any impairment losses (or gains) that should be recognised in the financial statements for the year to 30 June 2023, and(ii) Any gain or loss on disposal that should be recognised in the financial statements for the year to 30 June 2024if the carrying amount of the asset at 1 March 2023, its fair value (less costs to sell) on that date and on 30 June 2023 and its disposal proceeds are as follows:

The fair value (less costs to sell) of the disposal group is £3 million at 25 January 2023 and £2.85 million at 31 May 2023. The group is sold in August 2023 for £2.8 million.(a) Calculate the amount of any impairment losses (or gains) that should be recognised at 25 January 2023 and at 31 May 2023.(b) Calculate the gain or loss arising on the sale of the disposal group.

Step by Step Answer:

International Financial Reporting a practical guide

ISBN: 9781292439426

8th Edition

Authors: Alan Melville