Compared with its unadjusted debt-to-equity ratio, Mikkos debt-to-equity ratio as of December 31, 2018, after the adjustments

Question:

Compared with its unadjusted debt-to-equity ratio, Mikko’s debt-to-equity ratio as of December 31, 2018, after the adjustments suggested by Groff , is:

A . lower.

B . higher.

C . the same.

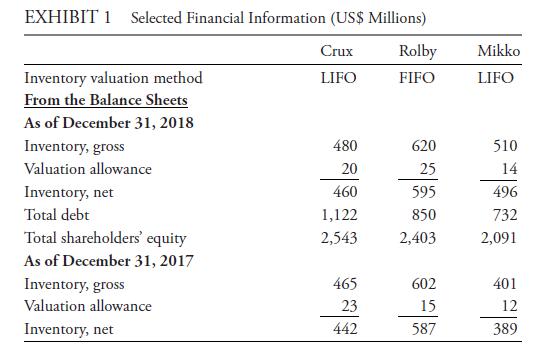

Robert Groff , an equity analyst, is preparing a report on Crux Corp. As part of his report, Groff makes a comparative fi nancial analysis between Crux and its two main competitors, Rolby Corp. and Mikko Inc. Crux and Mikko report under US GAAP, and Rolby reports under IFRS.

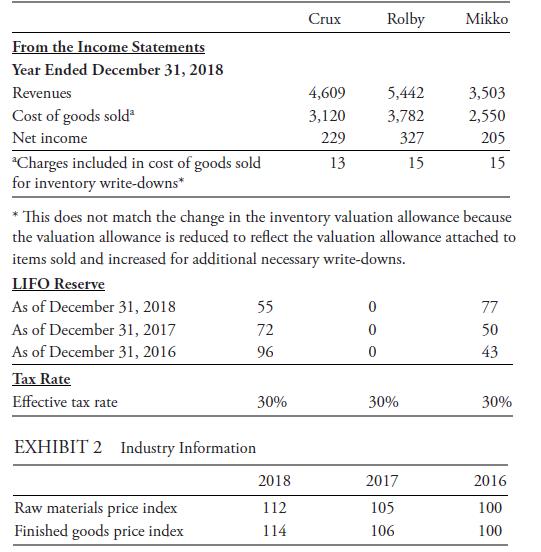

Groff gathers information on Crux, Rolby, and Mikko. Th e relevant fi nancial information he compiles is in Exhibit 1. Some information on the industry is in Exhibit 2.

To compare the fi nancial performance of the three companies, Groff decides to convert LIFO fi gures into FIFO fi gures, and adjust fi gures to assume no valuation allowance is recognized by any company.

After reading Groff ’s draft report, his supervisor, Rachel Borghi, asks him the following questions:

Question 1 Which company’s gross profi t margin would best refl ect current costs of the industry?

Question 2 Would Rolby’s valuation method show a higher gross profi t margin than Crux’s under an infl ationary, a defl ationary, or a stable price scenario?

Question 3 Which group of ratios usually appears more favorable with an inventory write-down?

Step by Step Answer:

International Financial Statement Analysis Workbook

ISBN: 9781119628095

4th Edition

Authors: Thomas R. Robinson, Elaine Henry, Wendy L. Pirie