If Karp had used FIFO instead of LIFO, its reported net income for the year ended 31

Question:

If Karp had used FIFO instead of LIFO, its reported net income for the year ended 31 December 2018 would have been higher by an amount closest to :

A . \($30\) million.

B . \($38\) million.

C . \($155\) million.

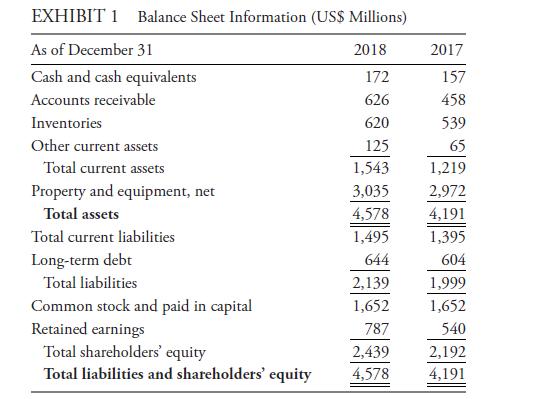

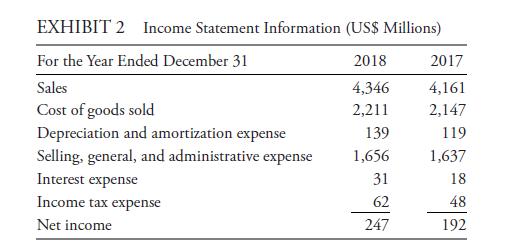

John Martinson, CFA, is an equity analyst with a large pension fund. His supervisor, Linda Packard, asks him to write a report on Karp Inc. Karp prepares its fi nancial statements in accordance with US GAAP. Packard is particularly interested in the eff ects of the company’s use of the LIFO method to account for its inventory. For this purpose, Martinson collects the fi nancial data presented in Exhibits 1 and 2.

Martinson fi nds the following information in the notes to the fi nancial statements:

• The LIFO reserves as of December 31, 2018 and 2017 are \($155\) million and \($117\) million respectively, and

• The effective income tax rate applicable to Karp for 2018 and earlier periods is 20 percent.

Step by Step Answer:

International Financial Statement Analysis Workbook

ISBN: 9781119628095

4th Edition

Authors: Thomas R. Robinson, Elaine Henry, Wendy L. Pirie