On 1 October 20X3, Penketh acquired 90 million of Spheres 150 million $1 equity shares. The acquisition

Question:

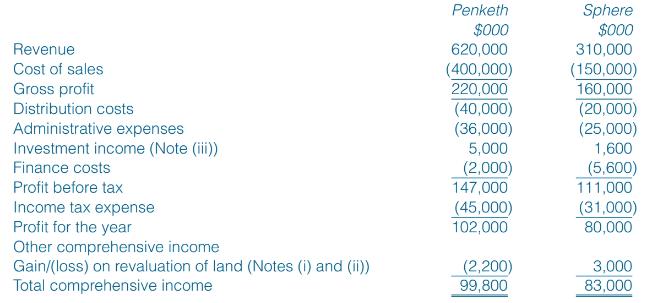

On 1 October 20X3, Penketh acquired 90 million of Sphere’s 150 million $1 equity shares. The acquisition was achieved through a share exchange of one share in Penketh for every three shares in Sphere. At that date the stock market prices of Penketh’s and Sphere’s shares were $4 and $2.50 per share respectively. Additionally, Penketh will pay $1.54 cash on 30 September 20X4 for each share acquired. Penketh’s finance cost is 10 per cent per annum. The retained earnings of Sphere brought forward at 1 April 20X3 were $120 million. The summarized statements of profit or loss and other comprehensive income for the companies for the year ended 31 March 20X4 are:

The following information is relevant:

(i) A fair value exercise conducted on 1 October 20X3 concluded that the carrying amounts of Sphere’s net assets were equal to their fair values with the following exceptions:

• The fair value of Sphere’s land was $2 million in excess of its carrying amount.

• An item of plant had a fair value of $6 million in excess of its carrying amount. The plant had a remaining life of two years at the date of acquisition. Plant depreciation is charged to cost of sales.

• Penketh placed a value of $5 million on Sphere’s good trading relationships with its customers. Penketh expected, on average, a customer relationship to last for a further five years. Amortization of intangible assets is charged to administrative expenses.

(ii) Penketh’s group policy is to revalue land to market value at the end of each accounting period. Prior to its acquisition, Sphere’s land had been valued at historical cost, but it has adopted the group policy since its acquisition. In addition to the fair value increase in Sphere’s land of $2 million.

(iii) On 1 October 20X3, Penketh also acquired 30 per cent of Ventor’s equity shares. Ventor’s profit after tax for the year ended 31 March 20X4 was $10 million and during March 20X4, Ventor paid a dividend of $6 million. Penketh uses equity accounting in its consolidated financial statements for its investment in Ventor. Sphere did not pay any dividends in the year ended 31 March 20X4.

(iv) After the acquisition Penketh sold goods to Sphere for $20 million. Sphere had one-fifth of these goods still in inventory at 31 March 20X4. In March 20X4, Penketh sold goods to Ventor for $15 million, all of which were still in inventory at 31 March 20X4. All sales to Sphere and Ventor had a mark-up on cost of 25 per cent.

(v) Penketh’s policy is to value the non-controlling interest at the date of acquisition at its fair value. For this purpose, the share price of Sphere at that date (1 October 20X3) is representative of the fair value of the shares held by the non-controlling interest.

(vi) All items in the above statements of profit or loss and other comprehensive income are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) Calculate the consolidated goodwill as at 1 October 20X3.

(b) Prepare the consolidated statement of profit or loss and other comprehensive income of Penketh for the year ended 31 March 20X4.

Step by Step Answer:

International Financial Reporting And Analysis

ISBN: 9781473766853

8th Edition

Authors: David Alexander, Ann Jorissen, Martin Hoogendoorn