A company, Rugger, manufactures two products: the Try and the Conversion. The company has traditionally allocated its

Question:

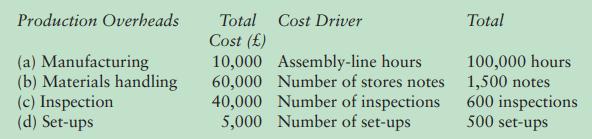

A company, Rugger, manufactures two products: the Try and the Conversion. The company has traditionally allocated its production overhead costs on the basis of the 100,000 direct hours used in the manufacturing department. Direct labour costs £10 per hour. The company is now considering using activity-based costing. Details of the overheads and cost drivers are as follows:

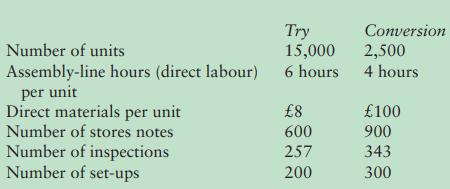

You have the following information about the products.

Required:

Required:

Calculate a product cost using

(i) traditional total absorption costing, recovering overheads using direct labour hours;

(ii) activity-based costing, and then

(iii) comment on any differences.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: