A football club, Manpool, is considering investing in a new stadium. There are the following expected capital

Question:

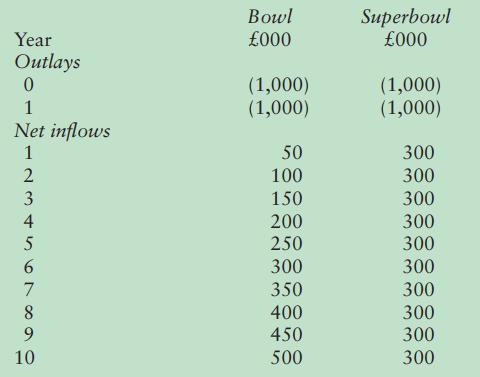

A football club, Manpool, is considering investing in a new stadium. There are the following expected capital outlays and cash inflows for two prospective stadiums.

Assume the football club can borrow money at respectively:

(a) 5%

(b) 8%

(c) 10%

Required:

(i) Which stadium should be built and at which rate using net present value?

(ii) What is the internal rate of return for the two stadiums?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: