Question: John Rees has the following information for the six months 1 July to 31 December. (a) Opening cash balance 1 July 8,600 (b) Sales at

John Rees has the following information for the six months 1 July to 31 December.

(a) Opening cash balance 1 July £8,600

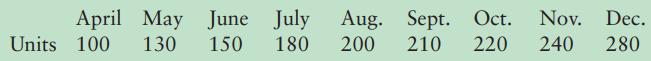

(b) Sales at £25 per unit:

Trade receivables will be paid two months after the customers have bought the goods.

(c) Production in units:

(d) Raw materials costing £10 per unit are delivered in the month of production and will be paid for three months after the goods are used in production.

(e) Direct labour of £6 per unit will be payable in the same month as production.

(f) Other variable production expenses will be £6 per unit. Two-thirds of this cost will be paid for in the same month as production and one-third in the month following production.

(g) Other expenses of £200 per month will be paid one month in arrears. These expenses have been at this rate for the past two years.

(h) A machine will be bought and paid for in September for £8,000.

(i) John Rees plans to borrow £4,500 from a relative in December. This will be banked immediately.

Required:

Prepare John Rees’s cash budget from 1 July to 31 December.

April May June July Units 100 130 150 180 Aug. Sept. Oct. 200 210 220 Nov. Dec. 240 280

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts