Pling Ltd has an authorised capital of 500,000 ordinary shares of 1 each and 250,000 10% preference

Question:

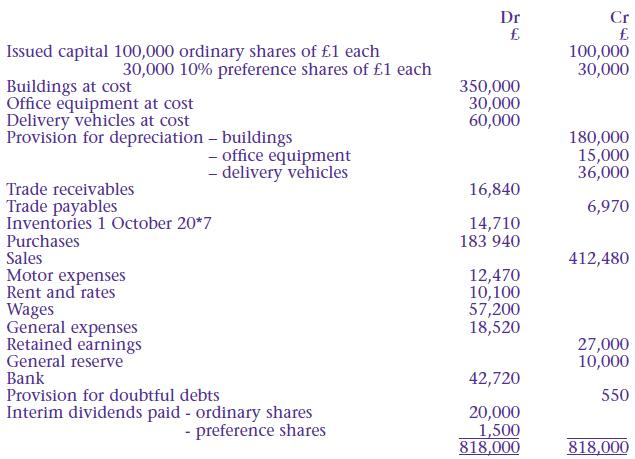

Pling Ltd has an authorised capital of 500,000 ordinary shares of £1 each and 250,000 10% preference shares of £1 each. The following trial balance has been extracted from the books of account at 30 September 20*8.

Additional information at 30 September 20*8

■ Inventories were valued at £16,320.

■ Wages accrued and unpaid amounted to £1,550.

■ Rates paid in advance amounted to £600.

■ Provision for doubtful debts is to be maintained at 5% of trade receivables outstanding at the year-end.

■ Depreciation is to be provided on non-current assets at the following rates:

– Buildings 2% on cost

– Office equipment 10% on cost

– Delivery vehicles 20% on cost.

■ The directors recommend

– A transfer to general reserve £10,000

– A final dividend on ordinary shares of £25,000 be provided

– A final preference dividend be provided

– Provision for corporation tax £28,420 be made.

Required

a) Prepare an income statement for the year ended 30 September 20*8.

b) Prepare a balance sheet at 30 September 20*8.

Step by Step Answer: