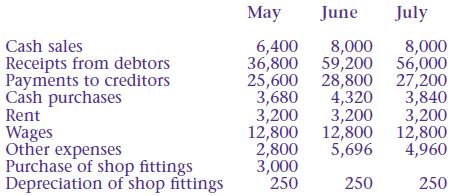

The following budgeted information relates to Chin Ltd for the three months ending 31 July 20*9. The

Question:

The following budgeted information relates to Chin Ltd for the three months ending 31 July 20*9.

The cash balance at 1 May 20*9 is expected to be £120.

Required

Prepare a cash budget for each of the three months ending 31 July 20*9.

Transcribed Image Text:

Cash sales Receipts from debtors Payments to creditors Cash purchases Rent Wages Other expenses Purchase of shop fittings Depreciation of shop fittings June July 6,400 8,000 36,800 59,200 25,600 28,800 3,680 4,320 3,200 3,200 May 8,000 56,000 27,200 3,840 3,200 12,800 12,800 12,800 2,800 5,696 4,960 3,000 250 250 250

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

To prepare the cash budget for each of the three months ending 31 July 209 we need to calculate the ...View the full answer

Answered By

Abdul Wahab Qaiser

Before working at Mariakani, I volunteered at a local community center, where I tutored students from diverse backgrounds. I helped them improve their academic performance and develop self-esteem and confidence. I used creative teaching methods, such as role-playing and group discussions, to make the learning experience more engaging and enjoyable.

In addition, I have conducted workshops and training sessions for educators and mental health professionals on various topics related to counseling and psychology. I have presented research papers at conferences and published articles in academic journals.

Overall, I am passionate about sharing my knowledge and helping others achieve their goals. I believe that tutoring is an excellent way to make a positive impact on people's lives, and I am committed to providing high-quality, personalized instruction to my students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following budgeted information relates to Rajpoot Ltd for the three months ending 30 October 20*9. The cash balance at 1 August 20*9 is expected to be 2,100. Required Prepare a cash budget for...

-

The following budgeted information relates to the business of Pierre: It is expected that: The cash balance at 1 June will be 350 overdrawn 5% of sales will be for cash 10% of purchases will be...

-

TickTock Ltd is a small company that sells antique clocks. The following budgeted information is available for the five months ending 31 October. Each clock costs $12.50. Each month 25 per cent of...

-

Question Description RangeFilterTester.java import java.util.ArrayList; class RangeFilterTester { public static void main( String[] args) { ArrayList accounts = new ArrayList(); accounts.add(new...

-

Presented below are two independent situations: (a) On January 1, 2015, Excess Inc. purchased undeveloped land that had an assessed value of $261,000 at the time of purchase. A $500,000,...

-

On January 1, 2003, Bowden Auto Repair had $3,560 worth of auto parts on hand. During the year, Bowden purchased auto parts costing $286,000. At the end of 2003, the company had parts on hand...

-

16. Let S = \($40\), = 0.30, r = 0.08, T = 1, and = 0. Also let Q = \($60\), Q = 0.50, Q = 0.04, and = 0.5. What is the price of a standard 40-strike call with S as the underlying asset? What is...

-

Xemex has collected the following inventory data for the six items that it stocks: Lynn Robinson, Xemexs inventory manager, does not feel that all of the items can be controlled. What ordered...

-

Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 34,000 Rets per year. Costs associated with this level of production and...

-

The following budgeted information is available for Hunter Ltd: It is expected that the cash balance at 1 February will be 3,200. Debtors are expected to settle their debts one month after sales have...

-

The following financial statements are provided for Bredgol plc at 31 January 20*9: All sales are credit sales Required Calculate: a) Gross margin b) Net profit margin c) Return on capital employed...

-

Suppose velocity is constant, the growth rate of real GDP is 3% per year, and the growth rate of money is 5% per year. Calculate the long-run rate of inflation according to the quantity theory in...

-

Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined...

-

Assume now that a new firm (firm N) discovers and patents a more efficient technology, summarized by thetotal cost function C = 10q. The new technology can be used only by the new firm, which enters...

-

1. How has Dell used virtual integration to become an industry leader? Dell has used virtual integration to become an industry leader by leveraging its global suppliers to reduce costs and provide...

-

3) Consider the asset pricing model with uncertainty in the slide. We derived the asset prices as Pb = Ps = - [nu' (y+Yn + e) + (1 )u' (y + y + e)] u'(e1) [nu' (y +n + ) + (1 )u' (y + y + e2)] u'(e1)...

-

Amazon is considered a leader in managing its supply chain. Describe in detail two parts of Amazon's Supply Chain Management that you see as critical to their success. Please provide your reasoning...

-

Suppose you are a human resource manager at a company that is going to gamify the job of its salespeople. How would job analysis help you advise the team on which behaviors to reward?

-

Explain the Hawthorne effect.

-

For each of the following items considered independently, indicate whether the circumstances call for an addition modification (A), a subtraction modification (S), or no modification (N) in computing...

-

Perk Corporation is subject to tax only in State A. Perk generated the following income and deductions. Federal taxable income .............. $300,000 State A income tax expense ............. 15,000...

-

In no more than three PowerPoint slides, list some general guidelines that a taxpayer can use to determine whether it has an obligation to file an income tax return with a particular state. (Include...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App