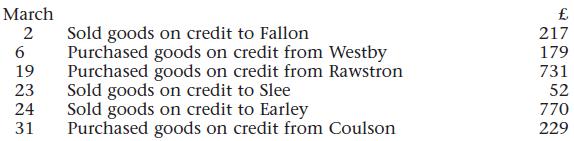

The following transaction took place during March 20*8: Required a) Enter the transactions in the appropriate books

Question:

The following transaction took place during March 20*8:

Required

a) Enter the transactions in the appropriate books of prime entry.

b) Show the necessary entries in the ledgers.

Transcribed Image Text:

March 2 6 19 23 24 31 Sold goods on credit to Fallon Purchased goods on credit from Westby Purchased goods on credit from Rawstron Sold goods on credit to Slee Sold goods on credit to Earley Purchased goods on credit from Coulson £ 217 179 731 52 770 229

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

a Entering Transactions in the Appropriate Books of ...View the full answer

Answered By

Sayee Sreenivas G B

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Rebecca owns a garage. The following transaction took place during March 20*8: Required a) Enter the transactions in the appropriate books of prime entry. b) Show the necessary entries in the...

-

The following credit transactions took place during December 20*8: Required a) Enter the transaction in the appropriate books of prime entry. b) Show the necessary entries in the ledgers. December 4...

-

Jim Kelly owns a clothes shop. The following transactions took place during June 20*8: Required a) Enter the transactions in the appropriate books of prime entry. b) Show the necessary entries in the...

-

A rectangular pontoon 10m long 7m broad & 2.5m deep weights 686.7KN. It carries on its upper deck an empty boiler of 5m diameter weighing 588.6 KN. The centre of gravity of the boiler and pontoon are...

-

Fernandez Corp. invested its excess cash in equity investments during 2010. The business model for these investments is to profit from trading on price changes. Instructions (a) As of December 31,...

-

Describe, compare and contrast rights issues and other share issues for a company already listed on a stock market.

-

5. The receipts from a special tax levy to retire and pay interest on general obligation bonds should be recorded in a: a Debt service fund b Capital projects fund c Revolving interests fund d...

-

Hazel Holden and Cedric Dalton are organizing Calgary Metals Unlimited Inc. to undertake a high-risk gold-mining venture in Canada. Hazel and Cedric tentatively plan to request authorization for...

-

A beverage shop operates a number of soft drinks. The fixed weekly expense of a soft drink is $2,200 and the variable cost per a drink is $0.44. Fill in the following table. Cans of soft drink served...

-

Which book of prime entry would be used to enter the following transactions? 1. Goods returned by Marshall, a customer. 2. Purchase of computer for use in the office on credit from Offo Ltd. 3. Goods...

-

The following credit transactions took place during August 20*8: Required a) Enter the transactions in the appropriate books of prime entry. b) Show the necessary entries in the ledgers. August 4 6...

-

Let A be a 3 3 matrix and suppose that 2a1 + a2 - 4a3 = 0 How many solutions will the system Ax = 0 have? Explain. Is A nonsingular? Explain.

-

Show how you would go about balancing the following equations: Cu + HNO3 Cu(NO3)2 + NO + H2O HIO3 + Fel2 + HCI FeCl3 + ICI + H2O 2.Conservation of mass A student places 0.58 g of iron and 1.600 g...

-

Sales MOSS COMPANY Income Statement For Year Ended December 31, 2021 Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Income before taxes Income taxes...

-

Prior to the Covid-19 epidemic, Master's and Ph.D. programs in psychology required applying students to submit their scores on the standardized graduate admission exam (GRE). For the past three...

-

Benicio wants to make sure that the Sales table does not contain any duplicate records, which would make any sales analysis incorrect. Identify and remove duplicate records in the Sales table as...

-

University Car Wash purchased new soap dispensing equipment that cost $261,000 including installation. The company estimates that the equipment will have a residual value of $27,000. University Car...

-

Your client is the planning office of a major university. Part of the job of the planning office is to forecast the annual donations of alumni through the university's long-established giving...

-

Suppose a population of bacteria doubles every hour, but that 1.0 x 106 individuals are removed before reproduction to be converted into valuable biological by-products. Suppose the population begins...

-

Which standard says that financial statements should be understandable?

-

Which standard deals with intangible non-current assets?

-

Which standard deals with the treatment of research and development costs?

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

-

The following schedule reconciles Cele Co.'s pretax GAAP income Pretax GAAP income Nondeductible expense for fines Tax deductible depreciation in excess of GAAP depreciation expens Taxable rental...

Study smarter with the SolutionInn App