Wong Ltd provides the following summarised balance sheet at 31 December 20*8: The non-current assets were revalued

Question:

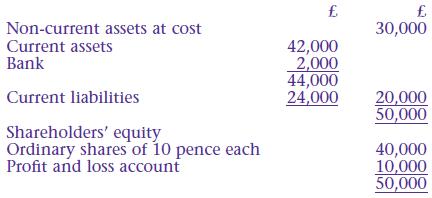

Wong Ltd provides the following summarised balance sheet at 31 December 20*8:

The non-current assets were revalued on 1 January 20*9 at £210,000.

Required

Prepare a summarised balance sheet at 1 January 20*9 after revaluing the non-current assets.

Transcribed Image Text:

Non-current assets at cost Current assets Bank Current liabilities Shareholders' equity Ordinary shares of 10 pence each Profit and loss account £ 42,000 2,000 44,000 24,000 £ 30,000 20,000 50,000 40,000 10,000 50,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

To prepare a summarised balance sheet at 1 January 209 after revaluing the noncurrent assets we need ...View the full answer

Answered By

Sayee Sreenivas G B

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Hox Ltd provides the following summarised balance sheet at 31 May 20*8: The non-current assets were revalued at 300,000 on 1 June 20*8. Required Prepare a summarised balance sheet at 1 June 20*8...

-

Mana Inc. had the following balances in its shareholders' equity at the beginning of the current year (January 1, 2021): Preferred shares ($ 1.50, cumulative", 100,000 shares authorized, 5,000 shares...

-

The following are extracts from the profit and loss accounts and balance sheets of Digby plc: Task: Comment on Digbys liquidity, capital structure, profitability and working capital management during...

-

Find a minimum spanning tree for the following graph using all 3 algorithms 13 17 22- 20 15, a. Adding the shortest edge first b. Deleting the longest edge first c. Growing a tree from the node D

-

Bearing Construction Company began operations in 2014. Construction activity for the first year is shown below. All contracts are with different customers, and any work remaining at December 31,...

-

When a mature injured firm has a temporary impairment of profits, the best compensatory damage measure is most likely. 3. a. Lost profits. b. Diminution of value. c. Unjust enrichment. d. Extra...

-

In contract costing the cost unit is (a) job (b) batch (c) unit produced (d) contract.

-

Presented below are the financial statements of Weller Company. Weller Company Income Statement For the year ended December 31, 2011 Sales ................... £242,000 Cost of goods sold...

-

An inexperienced accountant for Douglas Corporation made the following entries. July 1 Cash 180,000 Common Stock 180,000 Sept. 1 (Issued 20,000 shares of common stock, par value $6 per share) Common...

-

The summarised balance sheet of Norest Ltd at 31 January 20*8 is given. On 1 February 20*8 Norest Ltd issued a further 100,000 ordinary shares at a price of 30 pence per share. Required Prepare a...

-

Donald Ltd provides the following information after the first year of trading: Additional information The directors wish to transfer 40,000 to general reserve and recommend a final dividend of...

-

Weekly demand at a grocery store for a brand of breakfast cereal is normally distributed with a mean of 800 boxes and a standard deviation of 75 boxes. a. What is the probability that weekly demand...

-

Moving Inc. wants to develop an activity flexible budget for the activity of moving materials. Moving Inc. uses forklifts to move materials from receiving to storeroom and then to production. The...

-

We are in the tail end of Quarter 3 earnings reporting season in the U.S. markets. Roughly 60 percent of companies that have reported their Q3 earnings so far have reported negative earnings relative...

-

Below is a running shock tube illustration. 0.1 0.0 | 0.0 4 4 Diaphragm 1 0.5 Image: Shock tube Initial setup 1 3 2 1 Expansion Head Expansion Tail Slip Shock Surface Image: Running Shock Tube...

-

As you may remember, Holiday Tree Services, Inc. (HTS) has recently entered into a contract with Delish Burger (Delish), whereby HTS is to supply and decorate a Christmas tree in each of Delish...

-

Understanding various types of leadership styles is important in order to determine personal leadership styles. Reflection: Answer both Compare and contrast 2 leadership styles. State the...

-

What strategies can a company utilize towards winning back their customer base when recovering from bad times?

-

A non-charmed baryon has strangeness S = 2 and electric charge Q = 0. What are the possible values of its isospin I and of its third component I z ? What is it usually called if I = 1/2?

-

Identify the difference between a private limited company and a public limited company.

-

What is the difference between a marginal cost statement and an income statement?

-

How would total contribution be calculated?

-

Problem 12.6A (Algo) Liquidation of a partnership LO P5 Kendra, Cogley, and Mel share income and loss in a 3.21 ratio (in ratio form: Kendra, 3/6: Cogley, 2/6; and Mel, 1/6), The partners have...

-

Melody Property Limited owns a right to use land together with a building from 2000 to 2046, and the carrying amount of the property was $5 million with a revaluation surplus of $2 million at the end...

-

Famas Llamas has a weighted average cost of capital of 9.1 percent. The companys cost of equity is 12.6 percent, and its cost of debt is 7.2 percent. The tax rate is 25 percent. What is the companys...

Study smarter with the SolutionInn App