Question:

You owe your Mum £10. Is she a debtor or a creditor?

Your brother owes you £1. Is he a debtor or a creditor?

Balance sheets are presented in two main ways. At the moment we shall use what is known as the ‘horizontal layout’. Later, we will use a ‘vertical layout’.

The horizontal layout lists the assets of a business on the left of the page. It lists the liabilities opposite the assets on the right of the page.

Transcribed Image Text:

EXAMPLE

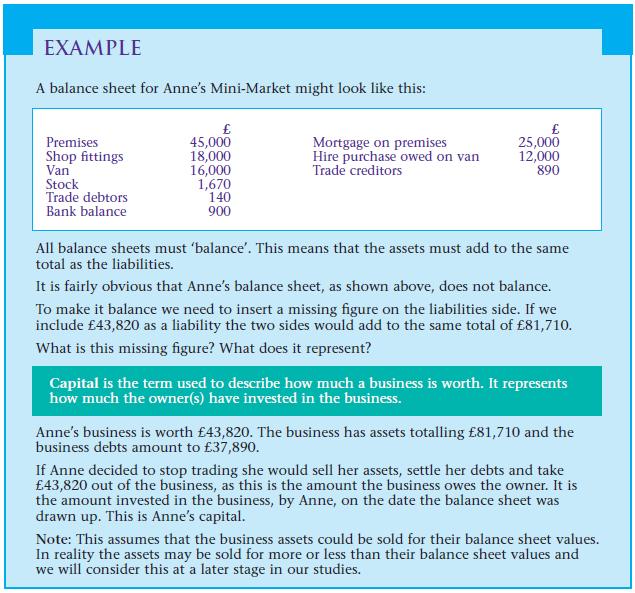

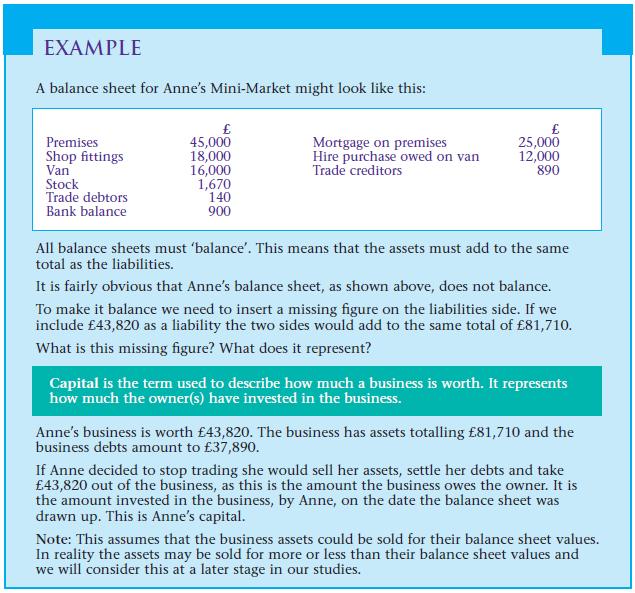

A balance sheet for Anne's Mini-Market might look like this:

Premises

Shop fittings

Van

Stock

Trade debtors

Bank balance

£

45,000

18,000

16,000

1,670

140

900

Mortgage on premises

Hire purchase owed on van

Trade creditors

25,000

12,000

890

All balance sheets must 'balance'. This means that the assets must add to the same

total as the liabilities.

It is fairly obvious that Anne's balance sheet, as shown above, does not balance.

To make it balance we need to insert a missing figure on the liabilities side. If we

include £43,820 as a liability the two sides would add to the same total of £81,710.

What is this missing figure? What does it represent?

Capital is the term used to describe how much a business is worth. It represents

how much the owner(s) have invested in the business.

Anne's business is worth £43,820. The business has assets totalling £81,710 and the

business debts amount to £37,890.

If Anne decided to stop trading she would sell her assets, settle her debts and take

£43,820 out of the business, as this is the amount the business owes the owner. It is

the amount invested in the business, by Anne, on the date the balance sheet was

drawn up. This is Anne's capital.

Note: This assumes that the business assets could be sold for their balance sheet values.

In reality the assets may be sold for more or less than their balance sheet values and

we will consider this at a later stage in our studies.