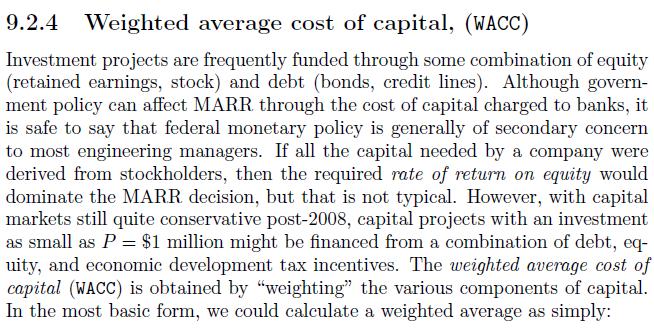

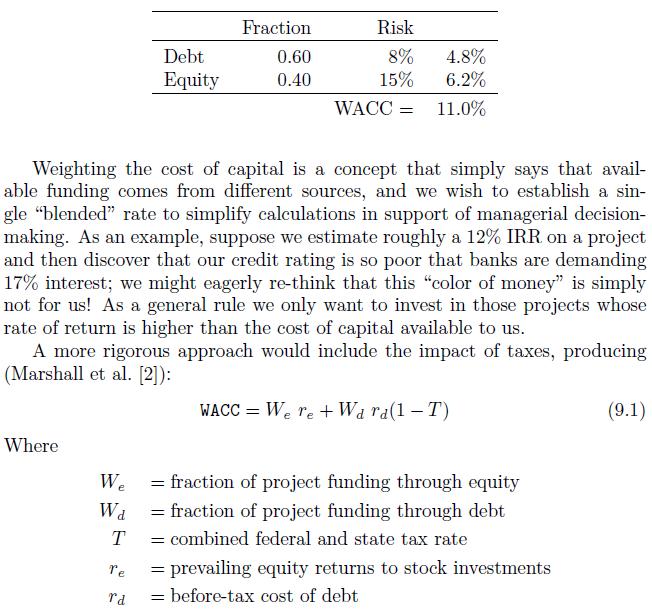

As discussed in Section 9.2.4, WACC is popular and routinely used in a variety of capital budgeting

Question:

As discussed in Section 9.2.4, WACC is popular and routinely used in a variety of capital budgeting situations. It seems, though, that the factor is not without controversy. What are some of the controversies and what cautions would you offer to avoid mis-use?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: