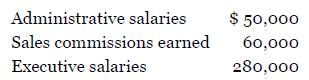

Sondeno Company has gathered the following payroll data for the month of July 2019. Assume the following

Question:

Sondeno Company has gathered the following payroll data for the month of July 2019. Assume the following rates: FICA, 7.65 percent (no employees have reached the maximum withholding for social security); federal income taxes for administrative and sales 15 percent, executives 25 percent; state income taxes, 10 percent of the federal income tax withholding; FUTA taxes, 0.6 percent; and SUTA, 5.4 percent. Assume that employees are paid at the end of each month.

Assume the following rates: FICA, 7.65 percent (no employees have reached the maximum withholding for social security); federal income taxes for administrative and sales 15 percent, executives 25 percent; state income taxes, 10 percent of the federal income tax withholding; FUTA taxes, 0.6 percent; and SUTA, 5.4 percent. Assume that employees are paid at the end of each month.

Required:

A. What is the net pay for Sondeno’s employees?B. What is the total payroll-related liability for Sondeno?C. What is the payroll-related expense for Sondeno?D. What are the amounts to be shown on the income statement, statement of cash flows, and balance sheet?

Step by Step Answer:

Introduction To AccountingAn Integrated Approach

ISBN: 9781119600107

8th Edition

Authors: Penne Ainsworth, Dan Deines