4. Transfer Pricing and Tax Avoidance (advanced). Electrolux, the Swedish multinational manufacturer of household appliances and white

Question:

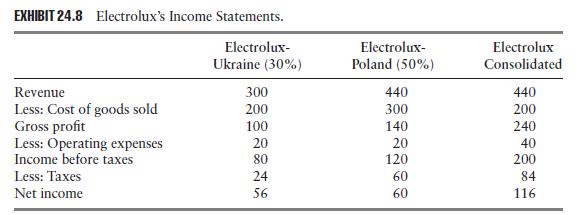

4. Transfer Pricing and Tax Avoidance (advanced). Electrolux, the Swedish multinational manufacturer of household appliances and white goods (refrigerators and washingmachines), manufactures compressors in Kiev (Ukraine) for assembly and distribution in Poland. Corporate income tax rates are, respectively, 30 and 50 percent in Ukraine and Poland. Make reference to income statements of both affiliates

(Exhibit 24.8) in answering the following:

a. Show how a manipulation of the transfer price between the Ukrainian subsidiary and its Polish sister subsidiary can reduce Electrolux’s consolidated taxes. Assume that the Polish subsidiary’s cost of goods sold is entirely accounted for by the compressor imports from Ukraine.

b. The European Union applies a 20 percent ad valorem tax on manufactured goods from Ukraine. Explain how this tax helps or hinders income shifting between the sister subsidiaries.

c. Intracorporate trade is conducted on 90-day credit terms. Electrolux-Ukraine expects the zloty to appreciate in the next three to six months; inwhich currency would you recommend that the exports shipment to Poland be denominated?

Should Electrolux-Poland lead or lag its payment? Should Electrolux-Ukraine lead or lag collection?

Step by Step Answer: