Bombardiers exports receivables (B). Royal Bank of Canada had just revised its forecast, saying that the CAD

Question:

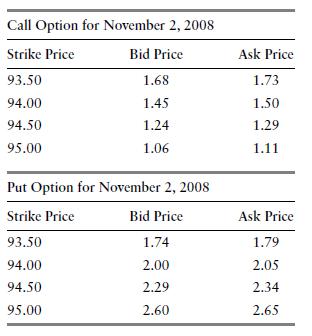

Bombardier’s exports receivables (B). Royal Bank of Canada had just revised its forecast, saying that the CAD would further rise to CAD 1 = US$1.08 before declining below parity by the middle of 2008. The currency desk at Royal Bank of Canada offered the following quotes for currency options. Indeed, Bombardier was now inclined to consider currency options as a possible hedge.

To get the CAD option premium, multiply the bid or ask price (expressed in percentage) by the face value of the contract.

a. Should Bombardier use call or put options in this case? Would you recommend a higher or lower strike price compared to the forward rate?

b. What is the cost for Bombardier to hedge with currency options as opposed to forward contracts? Be specific as to the timing of cash flows.

c. If indeed the currency forecast offered by the Royal Bank of Canada turned out to be correct, which hedging policy would have been best? Sketch your answer graphically.

Step by Step Answer:

International Corporate Finance Value Creation With Currency Derivatives In Global Capital Markets

ISBN: 9781119550464

2nd Edition

Authors: Laurent L. Jacque