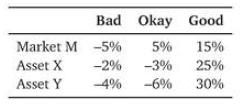

Q 8.27. Consider the following assets: 1. Compute the market betas for assets X and Y. 2.

Question:

Q 8.27. Consider the following assets:

1. Compute the market betas for assets X and Y. 2. Compute the correlations of X and Y with M. 3. Assume you were holding only M. You now are selling off 10% of your M portfolio to replace it with 10% of either X or Y. Would an M&X portfolio or an M&Y portfolio be riskier? 4. Is the correlation indicative of which of these two portfolios ended up riskier? Is the market beta indicative? Q

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: