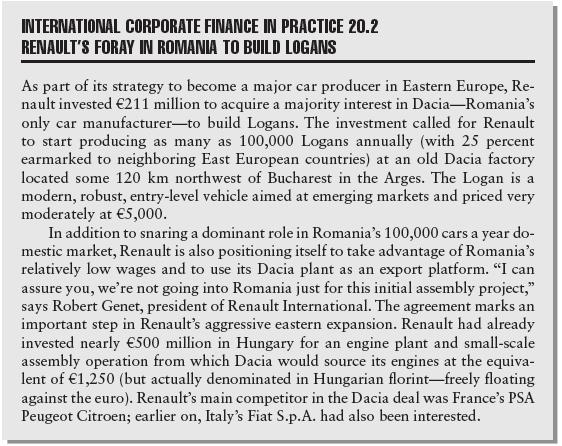

Referring to problem 5 and information provided in International Corporate Finance in Practice 20. 2 about Renault

Question:

Referring to problem 5 and information provided in International Corporate Finance in Practice 20. 2 about Renault investment in Dacia, prepare a five-year pro forma cash-flow statement for the project. Car sales are expected to reach 75,000 units in the first year of the project and will sell in leu (RON) for 20,000 or the equivalent of €5,000. Initial investment earmarked for the Dacia project is €500 million with an equity contribution from Renault of €150 million. The balance of the investment would be financed by a RON 800 million loan from the Romanian government at 7 percent per annum denominated in lei and €150 million from BNP Paribas, the French commercial bank, at 5 percent.

a. Show relevant cash flows in both local and reference currencies for valuation purposes. Assume that labor costs are RON 8,000 per vehicle; selling, general, and administrative expenses are 10 percent of sales; working capital is 5 percent of sales; and engines are imported from Hungary at the cost of RON 6,000 per unit (imports are paid in florint).

b. Explain how you would determine the appropriate discount rate for valuing the project. Renault’s P/E is 11 and its beta is 1. 1. Bucharest’s stock exchange index beta vis-à-vis the Paris Bourse is 0. 60. The Bucharest stock exchange is twice as volatile as the Paris Bourse. Renault is financed with 40 percent debt.

Romania’s sovereign debt is at 400 basis points over French 10-year eurodenominated treasuries. Spell out your assumptions.

c. Explain how you would account for the different kinds of risks faced by Renault in investing in Dacia, and show some simple results to help you decide whether to invest.

Note: The Romanian leu (RON) stood at €1 = RON 4 in January 2004, with inflation having declined from 25 percent in 2000 to 10 percent at the end of 2003.

Data from Practice 20. 2

Data from problem 5

Renault invests in Romania (A). Refer to International Corporate Finance in Practice 20. 2 on page 560 relating the French carmaker Renault’s entry into the Romanian automobile market. The year is 2004 and Romania is barely gaining associated status in the European Union. Full membership is a couple of years away. As the chief investment analyst for Renault, you are charged with the preparation of an in-depth analysis of the investment proposal and making a go/

no-go recommendation.

Step by Step Answer:

International Corporate Finance Value Creation With Currency Derivatives In Global Capital Markets

ISBN: 9781119550464

2nd Edition

Authors: Laurent L. Jacque