Singleton Supplies Corporation (SSC) manufactures medical products for hospitals, clinics, and nursing homes. SSC may introduce a

Question:

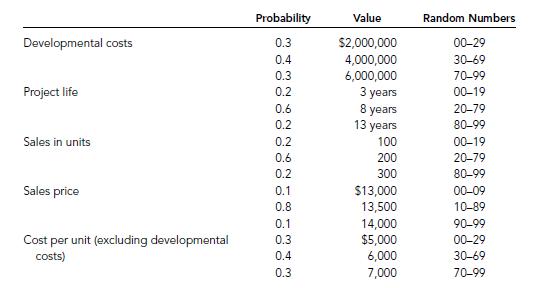

Singleton Supplies Corporation (SSC) manufactures medical products for hospitals, clinics, and nursing homes. SSC may introduce a new type of X-ray scanner designed to identify certain types of cancers in their early stages. There are a number of uncertainties about the proposed project, but the following data are believed to be reasonably accurate.

SSC uses a cost of capital of 15 percent to analyze average-risk projects, 12 percent for low-risk projects, and 18 percent for high-risk projects. These risk adjustments reflect primarily the uncertainty about each project’s NPV and IRR as measured by the coefficients of variation of NPV and IRR. SSC is in the 40 percent federal-plus-state income tax bracket.

a. What is the expected IRR for the X-ray scanner project? Base your answer on the expected values of the variables. Also, assume the after-tax “profits” figure you develop is equal to annual cash flows. All facilities are leased, so depreciation may be disregarded. Can you determine the value of IRR short of actual simulation or a fairly complex statistical analysis?

b. Assume that SSC uses a 15 percent cost of capital for this project. What is the project’s NPV? Could you estimate NPV without either simulation or a complex statistical analysis?

c. Show the process by which a computer would perform a simulation analysis for this project.

Use the random numbers 44, 17, 16, 58, 1; 79, 83, 86; and 19, 62, 6 to illustrate the process with the first computer run. Actually calculate the first-run NPV and IRR. Assume that the cash flows for each year are independent of cash flows for other years. Also, assume that the computer operates as follows: (1) A developmental cost and a project life are estimated for the first run. (2) Next, sales volume, sales price, and cost per unit are estimated and used to derive a cash flow for the first year. (3) Then, the next three random numbers are used to estimate sales volume, sales price, and cost per unit for the second year, hence the cash flow for the second year. (4) Cash flows for other years are developed similarly, on out to the first run’s estimated life. (5) With the developmental cost and the cash flow stream established, NPV and IRR for the first run are derived and stored in the computer’s memory. (6) The process is repeated to generate perhaps 500 other NPVs and IRRs. (7) Frequency distributions for NPV and IRR are plotted by the computer, and the distributions’ means and standard deviations are calculated.

Step by Step Answer:

Corporate Finance A Focused Approach

ISBN: 9780324180350

1st Edition

Authors: Michael C. Ehrhardt, Eugene F. Brigham