8.1 TOMS, a shoe retailer founded in 2006 by Blake Mycoskie, was founded on the One to...

Question:

8.1 TOMS, a shoe retailer founded in 2006 by Blake Mycoskie, was founded on the One to One principle.

For each pair purchased of TOMS shoes, the TOMS company would donate a pair to a child in need; over 60 million pairs of shoes have been donated worldwide so far. Sketchers, another shoe retailer, decided to release a line of shoes in 2010 and name them BOBS. For every purchase of BOBS, Sketchers will also donate a pair of shoes to a child in need; over 14 million pairs of shoes have been donated to date. This scenario provides an excellent example of an entry game.

Suppose you are making decisions for firms like Toms (Firm A) or Sketchers (Firm B). Suppose Firm A currently enjoys $20 million in profit each year. If Firm B enters the market with a similar product and Firm A does nothing, Firm A will lose $5 million in profit and Firm B will gain enough market share to earn $6 million in profit.

Firm A could try to combat the entry of Firm B by lowering prices, increasing advertising, or moving to a Two for One principle though this policy would lower their profit an additional

$5 million; but, if Firm A combats Firm B’s entry, Firm B’s estimated profits will be lower by

$7 million if they enter. Firm A could also take the same actions to combat entry if Firm B decided not to join the market; the effect on their profit is the same.

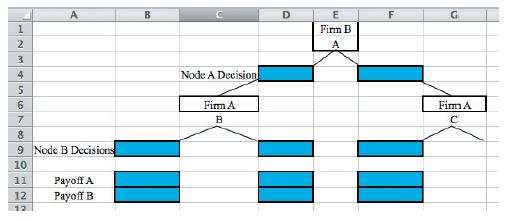

a. Using the template provided, create a tree modeling this game. Use Enter, Do Not Enter, Combat Entry, and Allow Entry as your decision options for each mode and enter payoffs in millions of dollars.

b. What will Firm A and B each decide to do?

c. How much profit will each firm make based on this decision?

d. Is a threat from Firm A to combat entry credible?

Why or why not?

Step by Step Answer: