In 2014, Mr. Walkovia acquired a vacant lot in a downtown area of the city intending to

Question:

In 2014, Mr. Walkovia acquired a vacant lot in a downtown area of the city intending to build an office complex. By late 2016, he decided to abandon the project. The property was disposed of just before the end of the year. Because of the unforeseen problems encountered in the development, it was not considered to have been held for speculation.

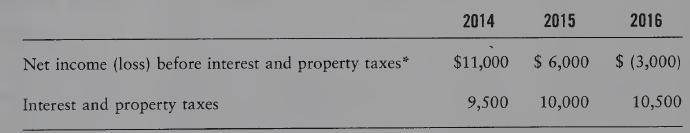

While the property was owned by Mr. Walkovia, it had been used as a city parking lot with the following results:

*This amount is equal to gross revenue in excess of all other expenses.

REQUIRED

(A) Consider the effect of these data on the income of Mr. Walkovia for tax purposes.

(B) If the land had been owned by a corporation whose principal business was the development and sale of land, what would be the effects of these data? Assume a prescribed rate of interest of 8% throughout the period in question.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett