Mr. Sam Moyer owns the following assets in a business that he wants to incorporate: 1 Cost

Question:

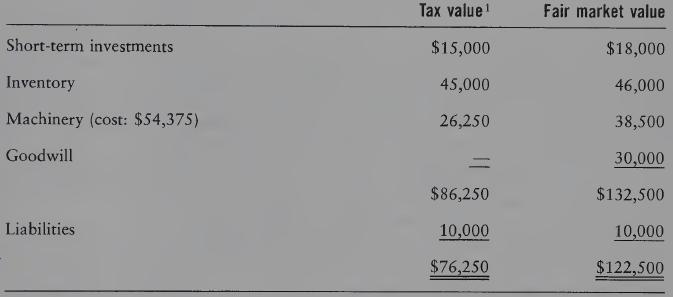

Mr. Sam Moyer owns the following assets in a business that he wants to incorporate:

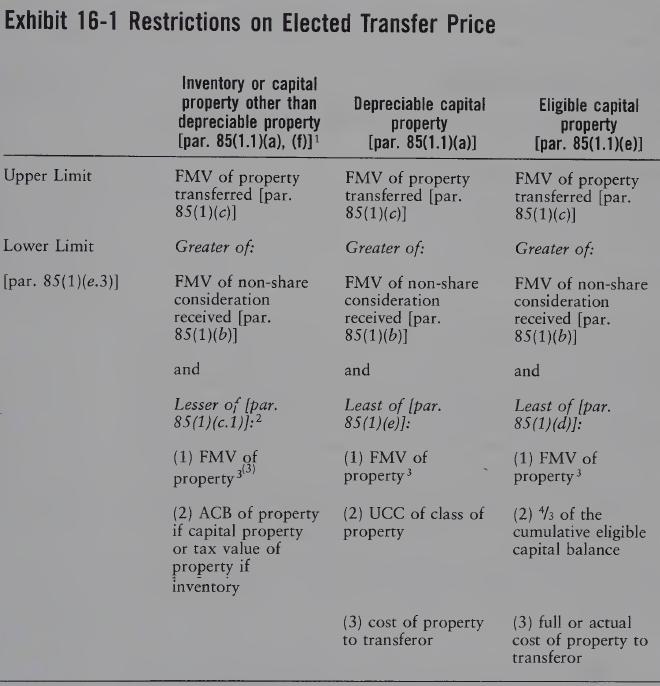

1Cost values for tax purposes used to describe the lowest limit of the elected transfer price range in Exhibit 16-1.

As fair market value consideration, he wants $70,000 in new debt, $35,000 in preferred shares and the balance in common shares to total the fair market value of the net assets transferred to the corporation. Also, the corporation will assume the existing debt of the proprietorship.

REQUIRED

Indicate the appropriate elected amounts which should be used to defer any taxation upon the incorporation of the proprietorship.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: