Universal Ltd.s tax return for its year ended December 31, 2016, showed the following balances in its

Question:

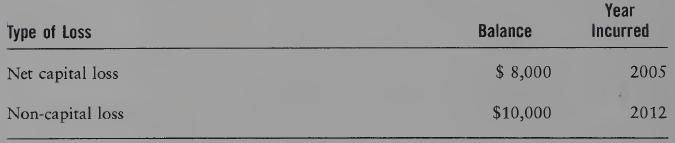

Universal Ltd.’s tax return for its year ended December 31, 2016, showed the following balances in its loss accounts:

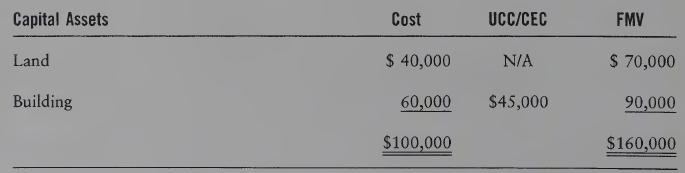

On June 1, 2016, an unrelated person acquired 75% of the voting shares of Universal Ltd. The accountant has calculated the business loss for the deemed year ended May 31, 2016, to be $25,000, including the accrued losses required to be recognized on the acquisition of control. The capital assets owned by Universal Ltd, at June 1, 2016, had the following values:

The accountant is projecting income of $100,000 for Universal Ltd. over the next 12 months. The projected income is from the business that incurred the losses.

REQUIRED

Universal Ltd. is considering making an election. Recommend the asset(s) that should be designated and the amount(s) which should be designated in the election.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett