Airborne Systems is a partnership owned by three individuals. The partners share profits and losses in the

Question:

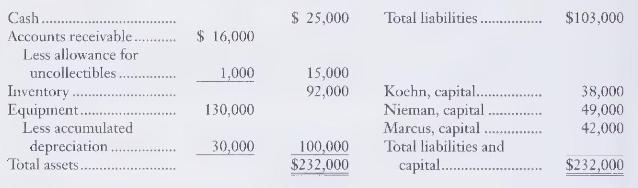

Airborne Systems is a partnership owned by three individuals. The partners share profits and losses in the ratio of 30 percent to Eve Koehn, 40 percent to Earl Neiman, and 30 percent to Ivana Marcus. At December 31, 19X6, the firm has the following balance sheet:

Koehn withdraws from the partnership on this date.

\section*{Required}

Record Koehn's withdrawal from the partnership under the following plans:

1. Koehn gives her interest in the business to Lynn Albelli, her cousin.

2. In personal transactions, Koehn sells her equity in the partnership to Matt Bullock and Shelley Jones, who each pay Koehn \(\$ 15,000\) for half her interest. Neiman and Marcus agree to accept Bullock and Jones as partners.

3. The partnership pays Koehn cash of \(\$ 5,000\) and gives her a note payable for the remainder of her book equity in settlement of her parthership interest.

4. Koehn receives cash of \(\$ 20,000\) and a note payable for \(\$ 20,000\) from the partnership.

5. The partners agree that the equipment is worth \(\$ 150,000\) and that accumulated depreciation should remain at \(\$ 30,000\). After the revaluation, the partnership settles with Koehn by giving her cash of \(\$ 10,000\) and inventory for the remainder of her book equity.

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.