Analysis of Transactions, Preparation of Statements . Wm. Wrigley Jr. Company manufactures and sells chewing gum. The

Question:

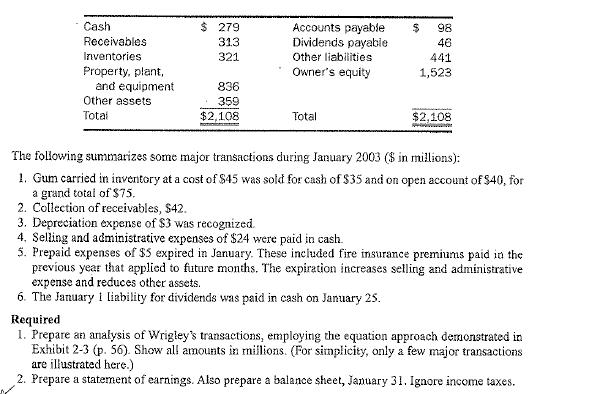

Analysis of Transactions, Preparation of Statements . Wm. Wrigley Jr. Company manufactures and sells chewing gum. The company's actual condensed balance sheet data for January 1, 2003 follows ($ in millions):

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Financial Accounting

ISBN: 0131479725

9th Edition

Authors: Charles T Horngren, John A Elliott

Question Posted: