Aspire plc develops and manufactures drugs for the pharmaceutical industry. The following information relates to the companys

Question:

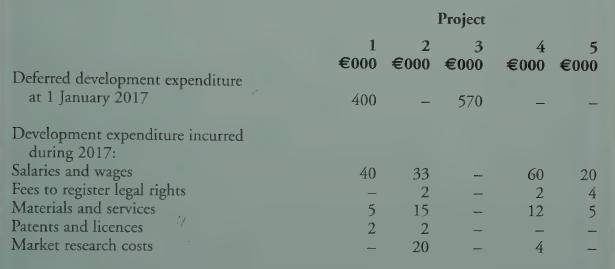

Aspire plc develops and manufactures drugs for the pharmaceutical industry. The following information relates to the company’s activities in research and development for the year ended 31 December 2017.

Additional Information:

Project 1: this project was originally expected to be highly profitable, but this is now in doubt as the high-profile scientist in charge of the project has left Aspire plc to join a competitor.

Project 2: €400,000 development expenditure on this project has already been written off in previous years. The directors now believe, on the best advice, that the project will earn revenue considerably in excess of all development costs and therefore now wish to reinstate the expenditure previously written off.

Project 3: commercial production started during the year. Sales were 30,000 units in 2017, and future sales are expected to be: 2018 — 60,000 units; 2019 — 40,000 units; 2020 —

10,000 units. No sales are expected after 2020.

Project 4: the costs related to the development of a new compound which meets the criteria for deferral of expenditure, and the development is expected to take three years.

Project 5: this is another new project, involving the development of a ‘loss leader’, expected to raise the level of future sales.

During 2017, Aspire plc spent €150,000 in order to exhibit its product range at a major overseas trade fair. This was the first time that Aspire plc had attended such an event. No orders have been received as a direct result of the fair, although the sales director has argued that contacts were made that will generate sales over the next few years. The company also spent €300,000 on staff training and development during the year. The company expects to achieve cost savings of €120,000 over the next three years.

Aspire plc’s accounting policy for research and development is in accordance with the requirements of IAS 38 Jnutangible Assets. In applying this policy, Aspire writes off development expenditure in relation to estimated sales of its products (in units).

Requirement

(a) Explain, with supporting calculations, how the above projects should be treated in the financial statements of Aspire plc for the year ended 31 December 2017.

(b) Explain how the costs associated with the trade fair and staff development should be treated in Aspire plc’s financial statements.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly