BiState Company's stockholders' equity on September 15 consisted of the following amounts: On September 15, when the

Question:

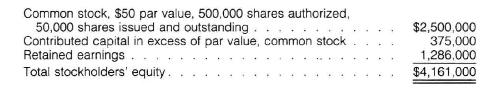

BiState Company's stockholders' equity on September 15 consisted of the following amounts:

On September 15, when the stock was selling at \(\$ 100\) per share, the corporation's directors voted a \(20 \%\) stock dividend, distributable on October 5 to the September 25 stockholders of record. The directors also voted a \(\$ 3.45\) per share annual cash dividend, payable on November 23 to the November 15 stockholders of record. The amount of the latter dividend was a disappointment to some stockholders, since the company had for a number of years paid a \(\$ 4\) per share annual cash dividend.

Nancy Cooper owned 1,000 shares of BiState Company stock on September 25, received her stock dividend shares, and continued to hold all of her shares until after the November 23 cash dividend. She also observed that her stock had a \(\$ 100\) per share market value on September 15 , a market value it held until the close of business on September 25, when the market value declined to \(\$ 90.50\) per share.

Give the entries to record the declaration and distribution or payment of the dividends involved here, and answer these questions:

a. What was the book value of Cooper's total shares on September 15 (after taking into consideration the cash dividend declared on that day)? What was the book value on October 5, after she received the dividend shares?

b. What fraction of the corporation did Cooper own on September 15? What fraction did she own on October 5 ?

c. What was the market value of Cooper's total shares on September 15? What was the market value at the close of business on September 25?

d. What did Cooper gain from the stock dividend?

Provocative Problem 13-3 Rutland Corporation (L.O. 4)

Step by Step Answer: