Clayton and Hammond are in partnership sharing profits and losses equally. The partnership agreement provides for annual

Question:

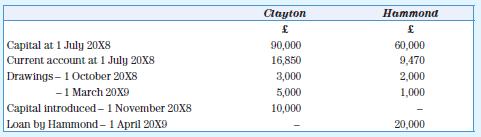

Clayton and Hammond are in partnership sharing profits and losses equally. The partnership agreement provides for annual salaries of Clayton: £17,000 and Hammond: £13,000. It also provides for interest on capital of 8 per cent per annum and interest on drawings of 4 per cent per annum.

The following additional information relates to the accounting year ending 30 June 20X9:

The profit for the year shown in the statement of profit or loss for the year ended 30 June 20X9 was £67,500.

Required

Prepare the appropriation account, capital account and current account. Show all the accounts in account format.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas

Question Posted: