Cohen Limited has three fixed-price contracts in progress during the year and the following UO details are

Question:

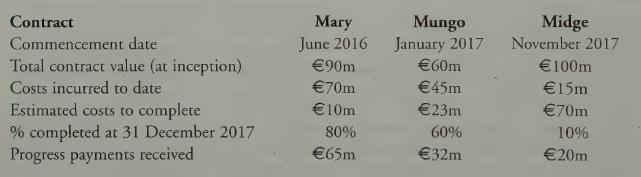

Cohen Limited has three fixed-price contracts in progress during the year and the following UO details are available for the year ended 31 December 2017.

Additional Information:

—

——

-— 1. Contract Mary commenced during 2016 and at 31 December 2016 was 50% complete;

accordingly, appropriate amounts for revenue and profit were included in the 2016 statement of profit or loss and other comprehensive income.

2. None of the contracts has a variable component and each is considered to contain only one performance obligation which will be satisfied over time. While it has been determined that an input method that uses the percentage of completion based on costs incurred appropriately predicts performance under the contract, it is believed that the outcome of a contract can only be estimated reliably once it has reached a minimum of 30% completion. A loss-making contract can be deemed ‘onerous’ in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets, with the loss reflecting the least net cost of exiting from the contract.

Requirement

(a) Illustrate how Cohen Limited should reflect the contracts in its financial statements for the year ended 31 December 2017.

(b) The Conceptual Framework for Financial Reporting 2018 (IFRS Framework 2018) effectively defines losses on individual transactions in such a way that they are associated with increases in liabilities or decreases in assets. JFRS Framework 2018 defines a liability as a “present obligation of the entity to transfer an economic resource as a result of past events”.

In addition, it states that for a liability to exist, each of the following three criteria must be satisfied:

(i) the entity has an obligation;

(ii) the obligation is to transfer an economic resource; and (iii) the obligation is a present one as a result of past events.

Explain how the definition of losses contained in JFRS Framework 2018 could be used to justify the requirement of IFRS 15 Revenue from Contracts with Customers to account for loss-making contracts as onerous contracts in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly