Extracts from the draft financial statements of Plum Plc for year ended 31 December 2017 show the

Question:

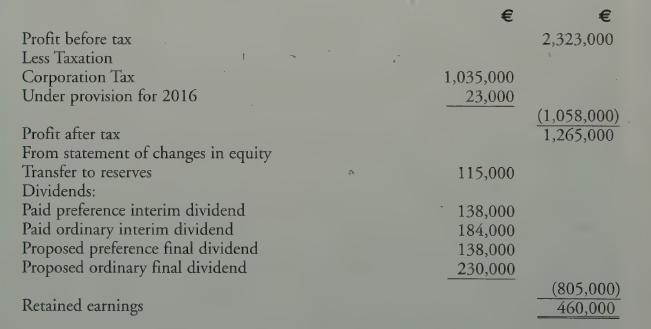

Extracts from the draft financial statements of Plum Plc for year ended 31 December 2017 show the following:

On 1 January 2017 the issued share capital of Plum Plc was 4,600,000 6% preference shares of €1 each and 4,140,000 ordinary shares of €1 each. The proposed dividends were approved by the shareholders during the year ended 31 December 2017. The preference dividends have not been charged in arriving at profit after tax in the statement of profit of loss and other comprehensive income.

Requirement Calculate the EPS (on basic and fully diluted basis) in respect of the year ended 31 December 2017 for each of the following circumstances (each of the four circumstances

(a) to

(d) is to be dealt with separately):

(a) On the basis that there was no change in the issued share capital of the company during the year ended 31 December 2017.

(b) On the basis that the company made a bonus issue on 1 October 2017 of one ordinary share for every four shares in issue at 30 September 2017.

(c) On the basis that the company made a rights issue of €1 ordinary shares on 1 October 2017 in the proportion of 1 for every 5 shares held, at a price of €1.20. The middle market price for the shares on the last day of quotation cum rights was €1.80 per share.

(d) On the basis that the company made no new issue of shares during the year ended 31 December 2017 but on that date it had in issue €1,150,000 10% convertible loan stock 2021-2024. This loan stock will be convertible into ordinary €1 shares as follows:

2021: 90 €1 shares for €100 nominal value loan stock;

2022: 85 €1 shares for €100 nominal value loan stock;

2023: 80 €1 shares for €100 nominal value loan stock;

2024: 75 €1 shares for €100 nominal value loan stock.

Assume tax at 50%.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly