Journalize the adjusting entry needed on December 31, end of the current accounting period, for each of

Question:

Journalize the adjusting entry needed on December 31, end of the current accounting period, for each of the following independent cases affecting Peters Construction Contractors, Inc.

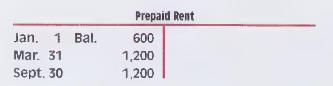

a. Details of Prepaid Rent are shown in the account:

Peters pays office rent semiannually on March 31 and September 30. At December 31, part of the last payment is still an asset.

b. Peters pays its employees each Friday. The amount of the weekly payroll is \(\$ 2,000\) for a fiveday work week, and the daily salary amounts are equal. The current accounting period ends on Monday.

c. Peters has loaned money, receiving notes receivable. During the current year the entity has earned accrued interest revenue of \(\$ 737\) that it will receive next year.

d. The beginning balance of Supplies was \(\$ 2,680\). During the year the entity purchased supplies costing \(\$ 6,180\), and at December 31 the cost of supplies on hand is \(\$ 2,150\).

e. Peters is servicing the air conditioning system in a large building, and the owner of the building paid Peters \(\$ 12,900\) as the annual service fee. Peters recorded this amount as Unearned Service Revenue. Dan Peters, the general manager, estimates that the company has earned one-fourth the total fee during the current year.

f. Depreciation for the current year includes: Office Furniture, \(\$ 850\); Equipment, \(\$ 3,850\); Trucks, \(\$ 10,320\). Make a compound entry.

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.