Journalize the adjusting entry needed on December 31, end of the current accounting period, for each of

Question:

Journalize the adjusting entry needed on December 31, end of the current accounting period, for each of the following independent cases affecting Brunansky Consulting Company.

a. Each Friday Brunansky pays its employees for the current week's work. The amount of the payroll is \(\$ 3,500\) for a five-day work week. The current accounting period ends on Thursday.

b. Brunansky has received notes receivable from some clients for professional services. During the current year, Brunansky has earned accrued interest revenue of \(\$ 9,575\), which will be received next year.

c. The beginning balance of Engineering Supplies was \(\$ 3,800\). During the year the entity purchased supplies costing \(\$ 12,530\), and at December 31 the inventory of supplies on hand is \(\$ 2,970\)

d. Brunansky is conducting tests of the strength of the steel to be used in a large building, and the client paid Brunansky \(\$ 36,000\) at the start of the project. Brunansky recorded this amount as Unearned Engineering Revenue. The tests will take several months to complete. Brunansky executives estimate that the company has earned three-fourths of the total fee during the current year.

e. Depreciation for the current year includes: Office Furniture, \(\$ 5,500\); Engineering Equipment, \(\$ 6,360\); Building, \(\$ 3,790\). Make a compound entry.

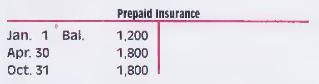

f. Details of Prepaid Insurance are shown in the account:

Brunansky pays semiannual insurance premiums (the payment for insurance coverage is called a premium) on April 30 and October 31. At December 31, part of the last payment is still in force.

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.