Kravitz Limited has identified an impairment loss of 100m in one of its cash-generating units (CGU). The

Question:

Kravitz Limited has identified an impairment loss of €100m in one of its cash-generating units (CGU). The CGU showed a carrying amount of €460m and a recoverable amount of

€360m at 31 December 2017. The loss of €100m is charged to the SPLOCI — P/L for the year ended 31 December 2017.

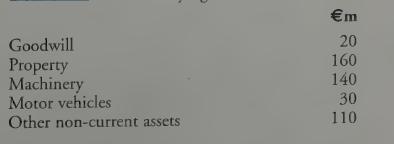

Details of the CGU carrying value

The fair value less costs to sell of the unit’s assets do not differ significantly from the carrying values, except for the property, which had a market value of €170m at 31 December 2017.

Requirement

(a) Show how the impairment loss would be allocated to the CGU assets for the year ended 31 December 2017.

(b) At the end of December 2018, a review showed that the conditions which led to the impairment charge in 2017 no longer exist. What is the amount of reversal of impairment charge that could be included in the SPLOCI — P/L for the year ended 31 December 2018? (Assume the remaining useful life is five years for each of the motor vehicles, machinery and other non-current assets at August 2017.)

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly