Marble plc (Marble) purchased 36,000,000 of the 45,000,000 1 ordinary shares in Falls Limited (Falls) on 1

Question:

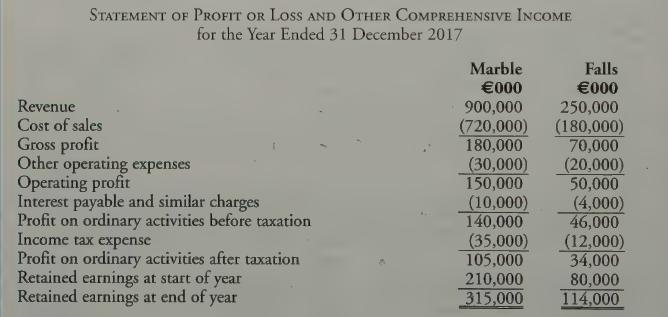

Marble plc (“Marble”) purchased 36,000,000 of the 45,000,000 €1 ordinary shares in Falls Limited (“Falls”) on 1 April 2017 for €200,000,000. The statements of profit or loss and other comprehensive income of both companies for the year ended 31 December 2017 are as follows:

Additional Information:

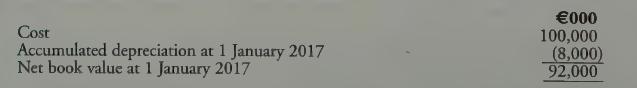

1. The only fair value adjustment that is required in respect of the acquisition of Falls relates to a building, the details of which are as follows:

The building, which had a useful economic life of 25 years on | January 2015, is in a prime commercial location and has increased dramatically in value since it was purchased by Falls on 1 January 2015. The replacement cost of a similar building, with a similar remaining useful economic life at 1 April 2017, is €161,000,000.

2. The activities of both companies occur evenly throughout the year. In June 2017, Marble sold goods to Falls for €30,000,000, and one-third of these goods remained unsold at 31 December 2017. Marble marks up the cost of goods sold by 25%.

3. Both Marble and Falls charge depreciation on a time-apportionment basis to net operating expenses. The directors of Marble believe that the goodwill arising on the acquisition of Falls has been impaired by €2,910,000 at 31 December 2017.

Requirement Prepare the consolidated statement of profit or loss and other comprehensive income of Marble Group for the year ended 31 December 2017.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly