Mumford Limited (Mumford) prepares its financial statements to 31 December each year. The company has been experiencing

Question:

Mumford Limited (“Mumford”) prepares its financial statements to 31 December each year.

The company has been experiencing trading difficulties in recent years as a consequence of the economic recession. |

For internal reporting purposes, Mumford is divided into two cash-generating units based —

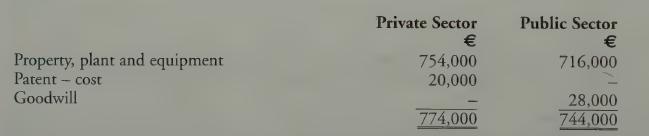

on the nature of the customer: Private Sector and Public Sector. The historic cost carrying value of the non-current assets of the two cash-generating units at 31 December 2017 is as follows:

In addition, the historic cost carrying value of Mumford’s head-office administrative property, plant and equipment at 31 December 2017 is €206,000. It is estimated that head office services the two cash generating units on an equal basis.

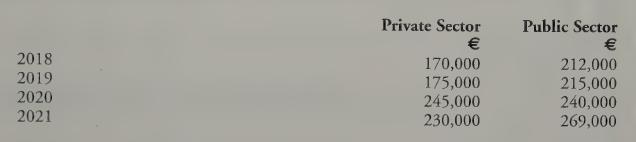

The directors of Mumford believe that the net realisable value of the Private Sector and Public Sector cash-generating units at 31 December 2017 is €651,000 and €538,000, respectively. With respect to the net realisable value of the Private Sector cash-generating unit, the directors estimate that the patent could be sold separately for €15,000. ie Sas prepared for the company’s bankers indicate the following projected net cash ows:

The required rate of return for both cash-generating units is 10%.

Requirement Calculate the extent of any impairment loss in the Private Sector and Public Sector cash-generating units and show clearly the necessary journal entries required to reflect any impairment loss in the financial statements of Mumford for the year ended 31 December 2017

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly