On 1 January 2015 Humpty Limited purchased 320,000 1 ordinary shares in Dumpty Limited. On this date

Question:

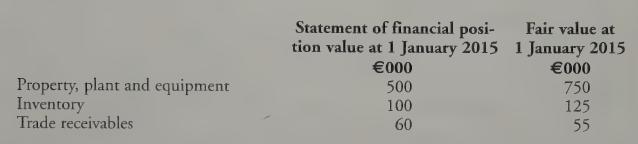

On 1 January 2015 Humpty Limited purchased 320,000 €1 ordinary shares in Dumpty Limited. On this date the fair value of Dumpty Limited’s separable net assets differed from their book values as follows:

However, Dumpty did not incorporate these fair values into its books of account. With respect to the measurement of non-controlling interests at the date of acquisition, the proportionate share method equated to the fair value method. The directors of Humpty believe that the goodwill arising on the acquisition of Dumpty was impaired for the first time by €345,000 during the year ended 31 December 2017.

On 1 January 2015, the property, plant and equipment of Dumpty Limited had a remaining useful life of five years and retained earnings stood at €150,000. During 2015 Humpty Limited incurred reorganisation costs of €200,000 in order to successfully incorporate Dumpty Limited into the group. None of the property, plant and equipment of Dumpty Limited purchased on 1 January 2015 has been sold at 31 December 2017, but the inventory purchased was sold at a profit during 2015.

During 2017 Dumpty Limited sold goods costing €160,000 to Humpty Limited for €200,000. At 31 December 2017 the inventory of Humpty Limited includes €50,000 (at cost to Humpty Limited) of the goods purchased from Dumpty Limited.

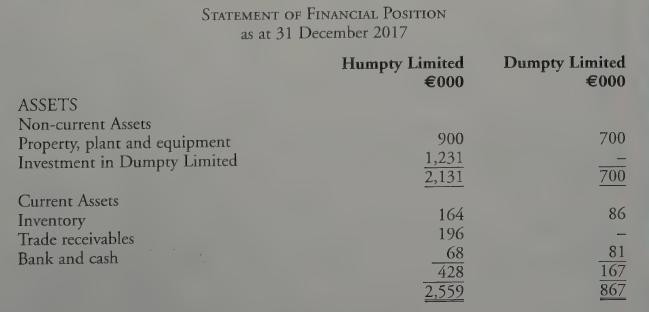

The individual company statements of financial position of Humpty Limited and Dumpty Limited at 31 December 2017 are as follows:

Requirement

(a) Prepare the consolidated statement of financial position for the Humpty group as at 3 December 2017,

(b) The remaining ordinary share capital of Dumpty Limited is owned by Egg Limited, a company that is wholly owned by a director of Dumpty Limited. During 2017 Egg Limited purchased property from Dumpty Limited. The sale price was set by an independent property surveyor. Discuss the implications of this transaction for the year ended 31 December 2017 with regard to IAS 24 Related Party Disclosures.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly