On 1 January 2017 Toffer acquired the following non-current investment: Three million equity shares in KTE by

Question:

On 1 January 2017 Toffer acquired the following non-current investment:

Three million equity shares in KTE by an exchange of one share in Toffer for every two shares in KTE, plus €1.25 per acquired KTE share in cash. The market price of each Toffer share at the date of acquisition was €6.00, and the market price of each KTE share at the date of acquisition was €3.25.

Only the cash consideration of the above investment has been recorded by Toffer. In addition,

€500,000 of professional costs relating to the acquisition of KTE is included in the cost of the investment.

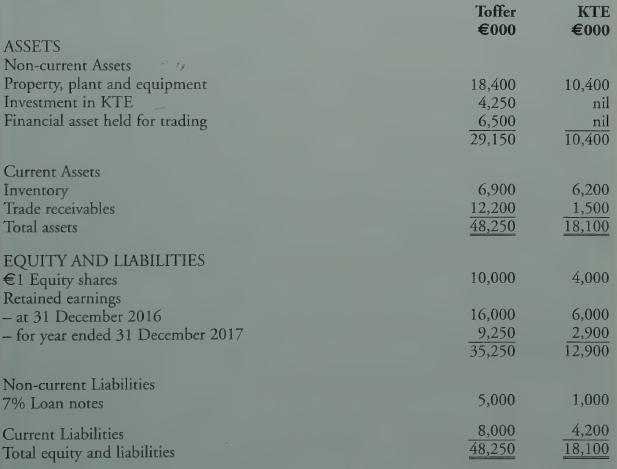

The summarised draft statements of financial position of Toffer and KTE at 31 December 2017 are:

Additional Information:

1. At the date of acquisition, KTE had five years remaining of an agreement to supply goods to one of its major customers. KTE believes it is highly likely that the agreement will be renewed when it expires. This customer agreement is not recognised in KTE’s financial statements above. The directors of Toffer estimate that the value of this customer-based contract has a fair value of €1 million, an indefinite life, and has not suffered any impairment.

2. On 1 January 2017, Toffer sold an item of plant to KTE at its agreed fair value of €2.5 million. Its carrying amount prior to the sale was €2 million. The estimated remaining life of the plant at the date of sale was five years (straight-line depreciation).

3. During the year ended 31 December 2017, KTE sold goods to Toffer for €2.7 million. KTE had marked up these goods by 50% on cost. Toffer had a third of the goods still in its inventory at 31 December 2017. There were no intragroup payables/receivables at 31 December 2017.

4, Toffer has a policy of valuing non-controlling interests at fair value at the date of acquisition.

For this purpose, the share price of KTE at this date should be used. Impairment tests on 31 December 2017 concluded that the goodwill arising on the acquisition of KTE had not been impaired.

5. The financial asset held for trading is included in Toffer’s statement of financial position (above) at its fair value on 1 January 2017, but it has a fair value of €9 million at 31 December 2017.

6. No dividends were paid during the year by either of the companies.

Requirement Prepare the consolidated statement of financial position for Toffer as at 31 December 2017.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly