Part 1. Transco Energy Company operates a pipeline that provides natural gas to Atlanta; Washington, D.C.; Philadelphia;

Question:

Part 1. Transco Energy Company operates a pipeline that provides natural gas to Atlanta; Washington, D.C.; Philadelphia; and New York City. The company's balance sheet includes the asset Oil Properties.

Suppose Transco paid \(\$ 8\) million cash for oil and gas reserves that contained an estimated 625,000 barrels of oil. Assume that the company paid \(\$ 350,000\) for additional geological tests of the property and \(\$ 110,000\) to prepare the surface for drilling. Prior to production, the company signed a \(\$ 65,000\) note payable to have a building constructed on the property. Because the building provides on-site headquarters for the drilling effort and will be abandoned when the oil is depleted, its cost is debited to the Oil Properties account and included in depletion charges. During the first year of production, Transco removed 82,000 barrels of oil, which it sold on credit for \(\$ 19\) per barrel.

\section*{Required}

Make general journal entries to record all transactions related to the oil and gas reserves, including depletion and sale of the first-year production.

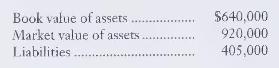

Part 2. United Telecommunications, Inc. (United Telecom), provides communication services in Florida, North Carolina, New Jersey, Texas, and other states. The company's balance sheet reports the asset Cost of Acquisitions in Excess of the Fair Market Value of the Net Assets of Subsidiaries. Assume that United Telecom purchased this asset as part of the acquisition of another company, which carried these figures:

\section*{Required}

1. What is another title for the asset Cost of Acquisitions in Excess of the Fair Market Value of the Net Assets of Subsidiaries?

2. Make the general journal entry to record United Telecom's purchase of the other company for \(\$ 850,000\) cash.

3. Assuming United Telecom amortizes Cost of Acquisitions in Excess of the Fair Market Value of the Net Assets of Subsidiaries over 20 years, record the straight-line amortization for one year.

Part 3. Assume that United Telecom purchased a patent for \(\$ 220,000\). Before using the patent, United incurred an additional cost of \(\$ 25,000\) for a lawsuit to defend the company's right to purchase it. Even though the patent gives United legal protection for 17 years, company management has decided to amortize its cost over a five-year period because of the industry's fast-changing technologies.

\section*{Required}

Make general journal entries to record the patent transactions, including straight-line amortization for one year.

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.