Part A. Suppose PepsiCo, Inc., completed the following transactions: May 4 Sold soft-drink syrup on account to

Question:

Part A. Suppose PepsiCo, Inc., completed the following transactions:

May 4 Sold soft-drink syrup on account to a Mexican company for \(\$ 71,000\). The exchange rate of the Mexican peso is \(\$ 0.0004\), and the customer agrees to pay in dollars.

13 Purchased inventory on account from a Canadian company at a price of Canadian \(\$ 100,000\). The exchange rate of the Canadian dollar is \(\$ 0.75\), and payment will be in Canadian dollars.

20 Sold goods on account to an English firm for 70,000 British pounds. Payment will be in pounds, and the exchange rate of the pound is \(\$ 1.50\).

27 Collected from the Mexican company.

31 Adjusted the accounts for changes in foreign-currency exchange rates. Current rates: Canadian dollar, \$0.76; English pound, \$1.49.

June 21 Paid the Canadian company. The exchange rate of the Canadian dollar is \(\$ 0.72\)

July 17 Collected from the English firm. The exchange rate of the British pound is \(\$ 1.47\).

\section*{Required}

1. Record these transactions in PepsiCo's general journal, and show how to report the transaction gain or loss on the income statement.

2. How will what you learned in this problem help you structure international transactions?

Part B. Suppose that Cunard, Inc., has a subsidiary company based in Japan.

\section*{Required}

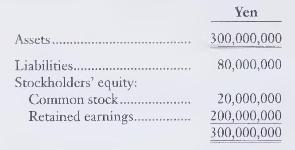

1. Translate into dollars the foreign-currency balance sheet of the Japanese subsidiary of Cunard, Inc. When Cunard acquired this subsidiary, the Japanese yen was worth \(\$ 0.0064\). The current exchange rate is \(\$ 0.0093\). During the period when the subsidiary earned its income, the average exchange rate was \(\$ 0.0089\) per yen.

Before you perform the translation calculations, indicate whether Cunard has experienced a positive or a negative translation adjustment. State whether the adjustment is a gain or a loss and show where it is reported in the financial statements.

2. How will what you learned in this problem help you understand published financial statements?

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.