Robin Forge established Forge Home Furnishings in January 19X7. During 19X7, (19 mathrm{X} 8), and most of

Question:

Robin Forge established Forge Home Furnishings in January 19X7. During 19X7, \(19 \mathrm{X} 8\), and most of 19X9, Forge kept the company's books and prepared its financial statements, although she had no training or experience in accounting. As a result, the accounts and statements contain numerous errors. For example, Forge recorded only cash receipts from customers as revenue. The sales method is appropriate for the business. She recorded inventory purchases as the cost of goods sold. When the current market value of her company's equipment increased by \(\$ 6,200\) in \(19 \times 7\) and by \(\$ 1,700\) in 19X9, Forge debited the Equipment account and credited Revenue. She recorded no depreciation during 19X7, 19X8, and 19X9.

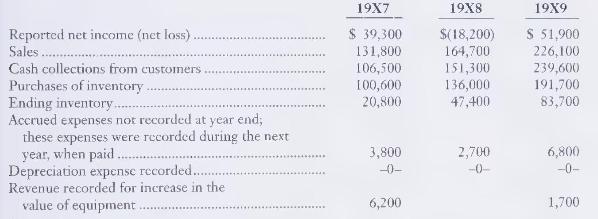

Late in 19X9 Forge employed an accountant, who determined that depreciable assets of the firm cost \(\$ 150,000\) on June \(30,19 X 7\), and had an expected residual value of \(\$ 10,000\) and a total useful life of eight years. The accountant believes the straight-line depreciation method is appropriate for Forge's plant assets. The company's fiscal year ends December 31. At the end of 19X9 the company's records reveal the amounts in the accompanying table.

\section*{Required}

1. Apply the concepts and principles of GAAP to compute the correct net income of Forge Home Furnishings for 19X7, 19X8, and 19X9.

2. How will what you learned in this problem help you manage a business?

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.