STATEMENT OF Profit or Loss AND OTHER COMPREHENSIVE INCOME for the Year Ended 31 December 2017 P

Question:

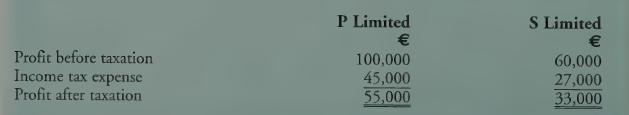

STATEMENT OF Profit or Loss AND OTHER COMPREHENSIVE INCOME for the Year Ended 31 December 2017

P Limited acquired 80% of S Limited on 30 April 2017.

Additional information on specific items in the newly acquired subsidiary’ statement of profit or loss and other comprehensive income is as follows:

1. Revenue and expenses The amount will include only the subsidiary’s post-acquisition revenue and expenses (generally time-apportioned).

2. Profit before taxation This will include only the post-acquisition results of the subsidiary (generally timeapportioned):

![]()

3. Disclosure items relating to profit before taxation In relation to depreciation, auditors’ remuneration and interest payable, they should be apportioned on a time basis and only the post-acquisition element should be included in the consolidated statement of profit or loss and other comprehensive income.

4. Income tax expense The taxation charge will include only the subsidiary’s post-acquisition taxation charge (generally time-apportioned):

![]()

Requirement Prepare the consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 2017.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly