Sweet plc was founded in the 1970s. During the 1980s Sweet plc relied on external acquisition to

Question:

Sweet plc was founded in the 1970s. During the 1980s Sweet plc relied on external acquisition to expand. For the last 7-8 years the group has focused on internal development.

However, on | January 2017, Sweet plc acquired 75% of the ordinary share capital of Gentle Limited. The purchase was financed by €365 million in cash and 50 million €1 ordinary shares with a market value of €75 million. The statement of financial position of Gentle Limited at 1 January 2017 showed:

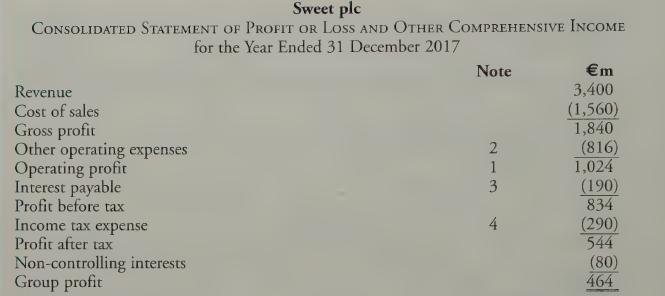

The directors of Sweet plc estimate that the goodwill arising on the acquisition of Gentle Limited had been impaired by €16 million at 31 December 2017. This has been charged to ‘other operating expenses’ in the consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 2017.

Additional Information:

1. Depreciation charged in arriving at operating profit in the consolidated statement of profit or loss and other comprehensive income of Sweet plc for the year ended 31 December 2017 amounted to €750 million.

2. There is a loss on disposal of property, plant and equipment of €26 million included in other operating expenses. This relates to the scrapping of plant and equipment during the year with a net book value of €26 million. No proceeds were received.

5. Additions to property, plant and equipment during the year include plant and equipment acquired under lease contracts which were initially measured at cost of €480 million in accordance with IFRS 16 Leases. Also, property was revalued upwards by €25 million and Sweet plc capitalised interest paid during the year of €10 million relating to the construction of a new factory.

6. During the year ended 31 December 2017, dividends of €240 million were debited to equity.

Requirement Prepare the consolidated statement of cash flows of Sweet plc for the year ended 31 December 2017 in accordance with IAS 7 Statement of Cash Flows.

(You are not required to provide notes to the consolidated statement of cash flows.)

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly