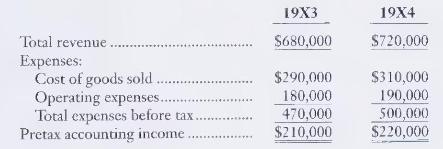

The accounting (not the income tax) records of Waterhouse Microfilms, Inc., provide the comparative income statement for

Question:

The accounting (not the income tax) records of Waterhouse Microfilms, Inc., provide the comparative income statement for 19X3 and 19X4:

Total revenue of \(19 \mathrm{X} 4\) includes rent of \(\$ 10,000\) that was received late in \(19 \mathrm{X} 3\). This rent is included in 19X4 total revenue because the rent was earned in 19X4. However, rent revenue that is collected in advance is included in taxable income when the cash is received. In calculating taxable income on the tax return, this rent revenue belongs in 19X3.

Also, the operating expenses of each year include depreciation of \(\$ 40,000\) computed under the straight-line method. In calculating taxable income on the tax return, Waterhouse uses the modified accelerated cost recovery system (MACRS). MACRS depreciation was \(\$ 60,000\) for \(19 \mathrm{X} 3\) and \(\$ 20,000\) for \(19 \mathrm{X} 4\).

\section*{Required}

Assume a corporate income tax rate of 35 percent.

1. Compute taxable income for each year.

2. Journalize the corporation's income taxes for each year.

3. Prepare the corporation's single-step income statement for each year.

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.