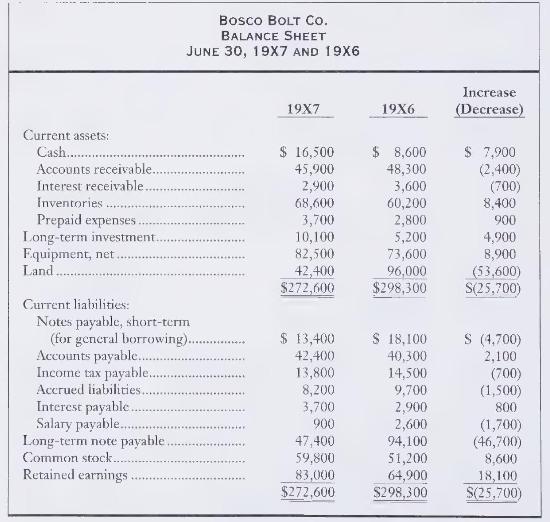

The comparative balance sheet of Bosco Bolt Co. at June 30, 19X7, included the following balances: Transaction

Question:

The comparative balance sheet of Bosco Bolt Co. at June 30, 19X7, included the following balances:

Transaction data for the year ended June \(30,19 X 7\) :

a. Net income, \(\$ 56,200\).

b. Depreciation expense on equipment, \(\$ 5,400\).

c. Purchased long-term investment, \(\$ 4,900\).

d. Sold land for \(\$ 46,900\), including \(\$ 6,700\) loss.

e. Acquired equipment by issuing long-term note payable, \(\$ 14,300\).

f. Paid long-term note payable, \(\$ 61,000\).

g. Received cash for issuance of common stock, \(\$ 3,900\).

h. Paid cash dividends, \(\$ 38,100\).

i. Paid short-term note payable by issuing common stock, \(\$ 4,700\).

\section*{Required}

1. Prepare the statement of cash flows of Bosco Bolt Co. for the year ended June \(30,19 \times 7\), using the indirect method to report operating activities. Also prepare the accompanying schedule of noncash investing and financing activities. All current accounts except short-term notes payable result from operating transactions.

2. Prepare a supplementary schedule showing cash flows from operations by the direct method. The income statement reports the following: sales, \(\$ 237,300\); interest revenue, \(\$ 10,600\); cost of goods sold, \(\$ 82,800\); salary expense, \(\$ 38,800\); other operating expenses, \(\$ 42,000\); depreciation expense, \(\$ 5,400\); income tax expense, \(\$ 9,900\); loss on sale of land, \(\$ 6,700\); interest expense, \(\$ 6,100\).

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.